So there’s been a bit of life in the crypto markets the past day or two. Bitcoin has been trending in a range. Cryptotwitter is debating whether it’s a descending triangle or a wedge, trying to predict whether a breakout up or down is coming. It looks to me that it’s in a consolidation zone. I have been holding off on purchasing much fiat to BTC, since I have other financial responsibilities that are taking precedence. Plus I have too much exposure, in general.

I have begun plans to phase out my use of Lending Club for investment purposes. I had started separate accounts for both of my kids, and was happy with the $25-50/month that I had been setting in there for them, with three to five percent interest. But around the time of the bull run, October 2017, I decided to start putting those funds into BTC, giving both of them their own wallets. I let Lending Club continue to reinvest the returned payments. Until recently.

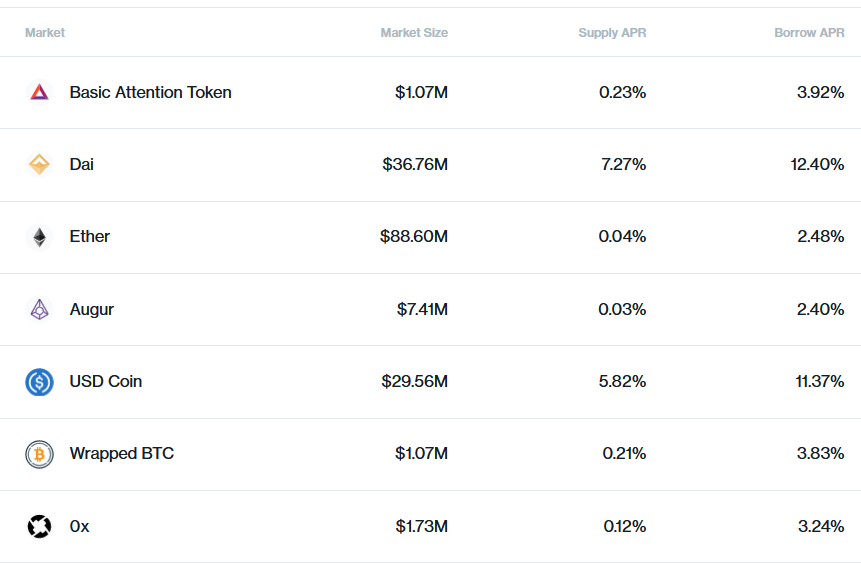

The big talk in the cryptoasset space right now is in decentralized finance, or DeFi. Most of the major apps in the space rely on Ethereum smart contracts, stable coins like Dai being the most prominent. I became aware of platforms like Compound, which allow lending and borrowing of several assets, like Dai, Ether, and others. The basic premise behind Compound is that people deposit their assets with the smart contract, and can then use those assets as collateral to which they can borrow other assets. The reasons why is something I really can’t explain. I assume most of it is speculative trading; a bit to risky for me given the borrrower APR.

Now with Dai, which tries to maintain a 1:1 parity with USD, has had a 20% stability fee assessed against it. Which is why it had a nearly twelve percent lending interest rate on Compound a few weeks ago. I had to try it out. I had some change on Coinbase, so I bought twenty bucks worth of Dai, transferred it to a Metamask wallet, and had it deposited at Compound in no time.

Now, this is not financial advice, and there is a risk with DeFi and smart contracts. There is the possibility that there is a flaw in either the Compound or Dai contracts, and something could go horribly wrong. But I’ve decided to stop reinvesting the kid’s funds on Lending Club, and will start moving their funds over to Compound as the loans are paid out. There’s no sense in lending USD at less than three percent, given that it’s hardly better than inflation. Now the rates on Compound and other DeFi applications can fluctuate daily as well, so I’ll need to keep an eye on things and make sure nothing crazy happens.

Given that I want to take advantage of this new opportunity, without increasing exposure to BTC directly, gaining high interest on stablecoins pegged to USD seems like a no brainer.