I spent some time this weekend working on my GBTC price predictor. The original idea behind this tool is to take the price action of BTC while the market is closed and use it to predict what will happen to the price of GBTC after the market opens. The original implementation uses the last close price of GBTC, and the price of BTC at the same time, then calculates the premium. It then retrieves the current price of BTC, then uses the calculated premium to determine what the current price of GBTC should be. It’s rather rudimentary, but serves as a quick and dirty calculator.

My hunch is that there are huge arbitrage opportunities to be found within the price action, especially when there are big moves in BTC’s price action. The big unknown, however, is the GBTC premium. The actual underlying value of a GBTC share is 0.009BTC, but the actual trading price fluctuates around 0.0012, so there’s some possibility to take advantage of this spread. We’re talking about the possibility of potential dollars in share price.

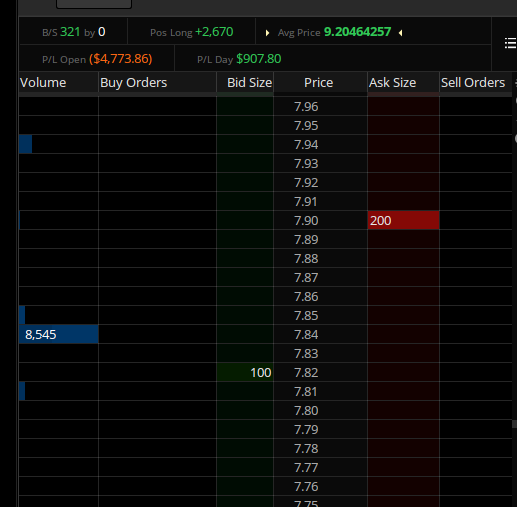

For example this morning, our calculation, based on the price of BTC at $7157, is that GBTC should be at $7.98-8.01 range. Here’s the current premarket spread.

The 7.82 bid order was quantity 800 about half an hour before open. Here’s the chart about five minutes after open.

The difficulty that we’re facing right now is matching the price action between the equity, GBTC, and the underlying crypto, BTC. For our inital purposes, it was enough to use the daily OHLCV data for the equity, and hourly data for the crypto. We only needed to track the crypto price at market close to get our initial premium value. But to do a proper arbitrage bot, we’ll need minute-by-minute data. This presents problems, since all of our work through the TDAmeritrade API has been via the REST API, and this work will involve streaming data via websockets, and likely some async programming.

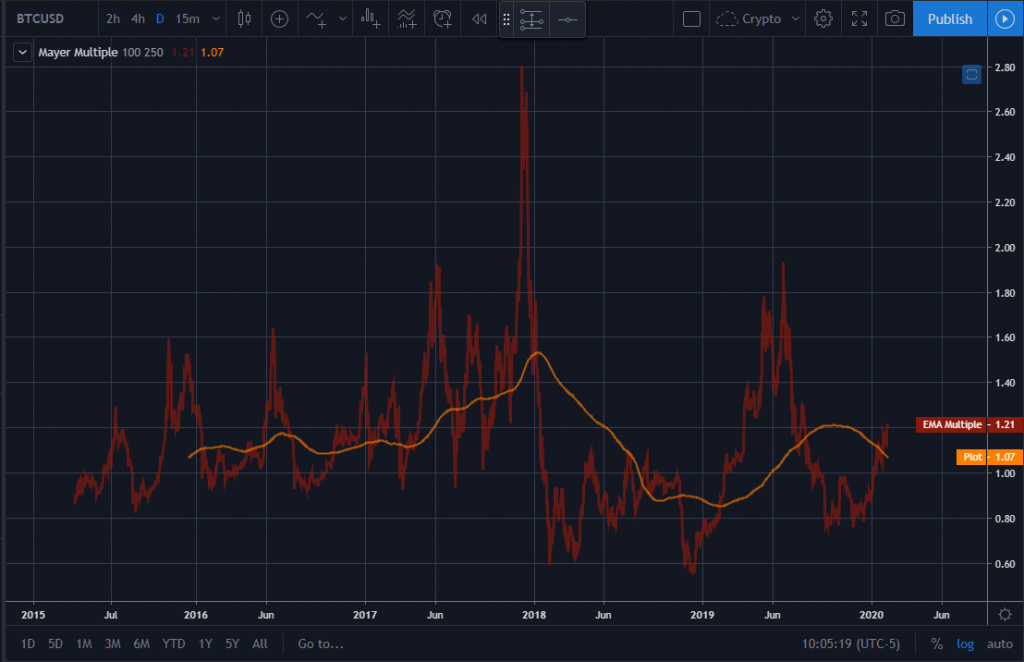

It would be nice to be able to see the intraday price action of the GBTC premium. Right now our free-tier TradingView account only gives us the daily interval, so being able to chart this ourselves is one of our priority. From there we can calculate some sort of moving average and standard deviation to determine when a price is out of band, and represents an arbitrage opportunity. It might be possible to configure something similar with TradingView, but since they don’t support TDA brokerages, we would be subject to a fifteen minute delay on the GBTC data. There’s also the cost factor. As an OTC listing, GBTC trades still have fees associated with them, so any arbitrage situations will have to be large enough to offset the trade.

I’ve got lots of changes that I need to make to the code; right now I’m running into some testing issues related to monkeypatching out the API calls. I’m planning on doing some real time charting using the Bokeh library, and this will have it’s own set of issues, I’m sure.