Spring seems to have arrived. Missus mentioned seeing a beautiful blue jay and robin flying around our deck a few days ago, and this morning I noticed the latter flying around the trees in the backyard. It’s still a bit chilly in the morning, but we’ve had several very warm days already this month, and I’m pretty sure this summer will probably be one of the hottest on record. Maybe reduced economic activity from COVID will have an impact, we’ll see.

I’m not really focused yet this morning, despite the chai. I got to a very critical part in Shantaram last night and couldn’t put it down, and didn’t fall asleep until after midnight, but I do feel pretty well rested. It’s amazing how much better I feel when I don’t drink a six-pack of beer, I don’t know why I keep falling back into that habit.

I’ve got a couple articles that I want to write. My personal update, the draft title for my “retirement” announcement, has been open in this web browser for over a week, and I don’t think I’ve looked at it once in the two weeks since I started writing it. Missus and I keep fighting about it. I’ve also got things I want to write about my USDC farming, a report on this Integral launch, and I want to help the GridPlus team build out their documentation.

But there’s work, and there’s the main reason that it has to go. I still have several projects that I need to wrap up before I can consider it a clean break. April 1st is Thursday, and that gives me sixty days to retire. (I’m pretty sure I started my Sixty to Six Figures goal around this time last year, if I recall..) Missus is still mad about it, or at me, rather, but keep oscillating in how she express it. She’s always lived the responsible life, and has been my cornerstone in many ways over the sixteen years we’ve been together. She’s been following the simple path to wealth, to borrow a phrase, putting in her years at her government job with an eye toward a pension. She’s halfway there, but the golden handcuffs are becoming more and more uncomfortable.

I’m trying to do everything I can to convince here that I’m not being irresponsible, but she’s seen me self-destruct several times over the years: a failed business, thirteen months on unemployment; I’m basically one for three as far as holding down a job has gone since we’ve been together. But also during that time we’ve had two kids, bought a house together, I’ve run for office twice and finished my bachelor’s degree. So it’s been an upward trajectory.

Her main concern is that I’ll revert to late-night drinking and video games, while she’ll be stuck holding down a real job so that she can provide health insurance for our family, which she’s done for the near decade that we’ve been together. It’s a valid concern, but not one that I’m worried about, as I’m confident that I’ll be able to hold things together. But it’s also true that I’ve been doing the brunt of managing the kids and household during COVID, playing peacemaker, cook, and tutor for the kids while she’s on the clock, locked in the room upstairs. The health insurance question is something I am struggling with though.

Her other main objection is our mortgage and my student loan debt, the latter of which is suspended until September. No telling what the Biden administration is going to do, but there’s no way I’m paying a dime of that off before it’s due. I thought that having eighteen months’ expenses in cash would be enough to assaugue her concerns, but when I filled up the little fundraising thermometer on our fridge’s whiteboard I think it actually set her off. “I’ve got $x in cash, does that mean I can retire too?” she asked.

Based on my early calculations, I need around $1.2m in capital to hit my FIRE number — monthly expenses * 300 ( or annual * 24). That was considering all of the mortgage debt. Just my portion, including my upcoming student loan payments, is about a million, and the high end case there is just under $1.4m. This FIRE number is basically what we need to live off of, considering a 4% interest annual gain. ($1.4m * 0.04 = $56k, which is slightly under my annual salary. Adding up all of our net assets, including my debts, our house and our retirement accounts, Missus and I blew through all of these numbers in the past six months.

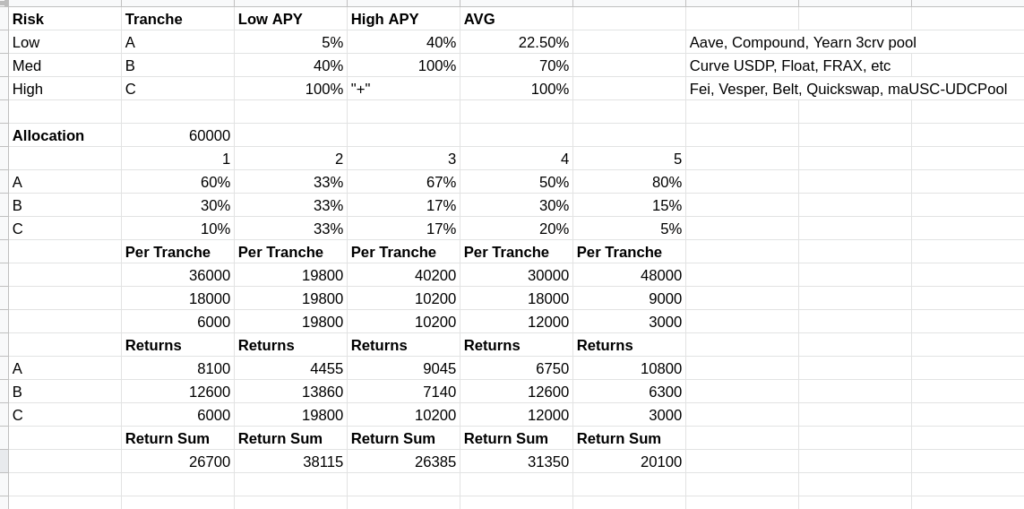

DeFi has changed this calculation significantly. BlockFi and other crypto lenders are currently offering upwards of eight percent which cuts our refirement number in half. And even better yields can be found on chain, with Curve and Yearn vaults providing rates anywhere from 15-40%. These are the “safe” options. There are newer protocols and launches that are offering more than 100% APY, although these opportunities are fast and fleeting. A risk-adjusted capital allocation to these pools should be able to return between 33-63% APY, depending on risk allocation. I’m currently targeting the low end of the curve.

Maintaining an income is going to be a bit trickier. There are vault transaction fees that will make moving in and out of these positions a bit expensive, but compounding results will make this a bit easier to swallow. And we’re only talking about managing a fraction of my net worth. I’ve still got a lot of options available if I need cash. For that there’s the restt of my portfolio, including my bitcoin stash.

I’ve tried to explain the opportunity cost to paying off our/my debts to Missus. All she sees is the numbers on the board. As a percentage of net worth, it’s nowhere near what it was a year ago. (I need to add those numbers to our whiteboard.) I figure the next two months will make them even smaller. If bitcoin does what bitcoin does, then wiping that board clean come June 1 should be an easy decision. I could do it now, but I’ve already taken a considerable amount out of the market, and will wait for $100k BTC. Considering that I expect $300-400 BTC before the end of the year, I don’t want to convert funds too early, but my expedited timeline might make that a necessity.

Of course I have IRA funds available. Taking the early withdrawal penalty plus short term capital gains would seem boneheaded to your standard wealth manager, but I’d rather take the one-time hit and still have BTC on hand than sell the BTC and be relatively broke. The money in the IRA grew so fast thanks to GBTC, MARA, RIOT, and Voyager, so I have no problem taking the penalty on those funds to keep cash on hand.

So we’ve got at least two months for things to play out before I need to make any decisions. For now, I’ve got work to do.