So I’ve been experimenting with Perpetual Finance for about a month now, and after today’s BTC pump over 40k I finally decided to take the plunge and invest a significant amount on the platform. Also, I won their Pool Together lotto.

PerpFi is an on-chain, decentralized perpetual contract for crypto assets such as bitcoin, ethereum, and DeFi blue chips. They offer up to 10x leverage, short or long, and use the xDAI network for super low transaction fees. All trades are denominated in USDC, and they’re offering no-gas bridging if you move more than $500 over to the xDAI network. They have a governance token, PERP, and also provide trading rewards in the form of a Pool Together token which pays out in PERP tokens. This is how I won the lotto.

Perpetual contract are a type of financial instrument that is native to crypto. It’s similar to a futures contract, but the difference here is that unlike traditional futures, perpetuals do not have expiration dates, meaning that one can long or short an asset and hold the position indefinitely. FTX and dydx are two centralized platforms that provide perpetuals, Perp.Fi is the first decentralized on-chain platform for this.

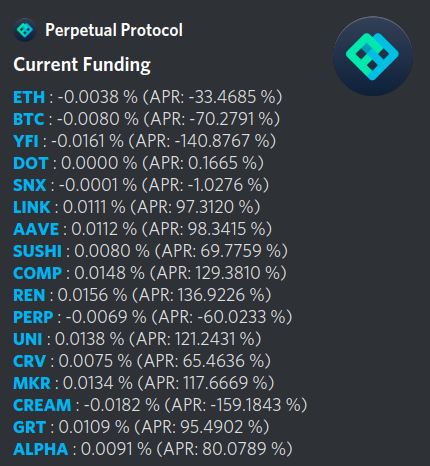

Since perpetuals allow leverage, there are funding costs associated with positions. These costs are determined by the difference between the price of the perpetual contract and the oracle spot price. If the perp price is below spot, then a premium is paid to those who take long positions. This is how our strategy works. Here’s a snapshot for all the current Perp.Fi trading pairs:

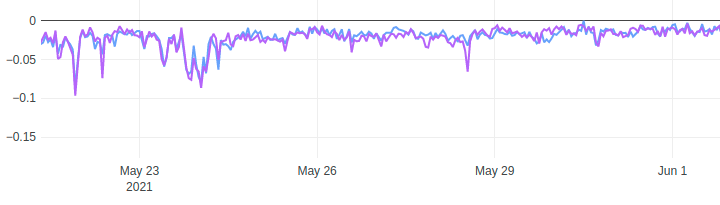

Again, anything with a negative rate is actually generated by shorts paying longs. Rates were actually a bit higher today, around 133% for ETH. For ETH and BTC, historical rates have always been negative, due to the fact that Perp.Fi is primarily used to short these assets.

I first started experimenting with Perp.Fi about a month ago, taking out a few 5x long positions on ETH and BTC. 5x is actually kind of aggressive for a long-term position, and I actually wound up getting partially liquidated a few weeks ago when we had that dip late last month, losing about a third of my position. Since then, however, the funding rate has almost paid back what I lost. And since one can take an un-liquidatable 1x long position on Perp, it’s pretty much a no-brainer for me to move my wBTC positions out of underperforming yield farms and put them into Perp. I’d also argue that Perp.Fi makes more sense than holding Index Coop’s ETH and wBTC 2x FLI tokens, since they both suffer from a 2% management fee as well as funding expenses from their underlying components.

Recently I’ve been experiencing a bit of anxiety over a bit of underperformance in my stablecoin reFIREment fund. I’m short on cash and was facing the prospect of having to spend some of my stablecoin yield farms. I think these perp contracts may have given me a way to not only stave off dipping into those funds. I’ve opened a low-leverage, 1.5x position on the platform, equivalent to my annual expenses. The funding, it if maintains a 100% APR, will allow me to remove margin from my account and send it to my expense account. Perhaps a bit more explaining is necessary.

Let’s say you do as I did today and open a 1.0 BTC position with 1.5x leverage at $40,000. Your upfront capital is $40k, but you’re actually holding a $60,000 BTC position. The funding rate is based on your position size, not your margin, but the funding is paid to your margin. So while you might initially start your position with a liquidation price around $15,000, as each hour passes, the funding rate will lower your liquidation price. Perp.Fi allows you to add or remove margin, so you can actually remove margin over time, keeping your liquidation price steady, and allowing your to either add to you position or cash out. Herein lays my strategy.

I’m hoping that the funding rate will be sufficient for me to maintain this low-leverage position indefinitely, removing the funding proceeds from my margin. Of course the rate is variable, so I’ll be keeping a close eye on things. And of course there’s the risk from carrying a leveraged position, both from price volatility and liquidation risk. That said, I think the bottom is in an there is zero chance that bitcoin goes below 20k. (Famous last words.) If I wanted to be more aggressive I could remove more margin and lever up my position, but I think I have a somewhat conservative position here that is mostly risk free and will allow me to pay my mortgage and grocery bills.