Woke up to $BTC over $17k.

I’ve completely obsessed lately, keeping TradingView and my IRA up on my laptop while I’m working on my day job, which has been demoted to just a single screen on my dual monitor setup. I check Zapper.Fi daily, and am on Twitter constantly during the day.

I’m still doing my job, taking care of anything urgent or important, delegating as much as I can. Ultimately, nothing is as important as what’s going on in the markets, so I’m constantly reading and trying to figure out what the long term plan is going to be.

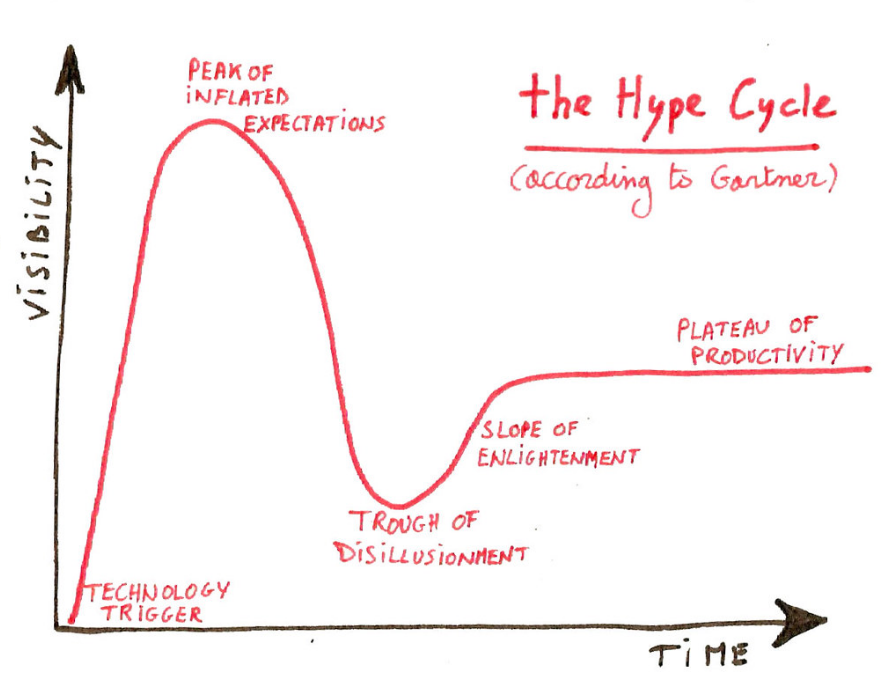

This Tweetstorm has a couple good points. One I’ve been thinking about and seen a few times before is that this isn’t going to be like the last couple cycles, with a blow-off top and an eighty percent drawdown. My plan during the past few months was that I would sell a portion of my holdings off and save it for a drawdown. But what if there’s not a drawdown?

My target is dynamic, it’s based off the moving average at the last top, about 3.6x the 200 day moving average. That equates to a price of $39,000. The longer we take to get there, the higher the price will be, so we might now have a huge runup like we saw before. Since we’re seeing institutional players in the market now, they’re more patient, will move slower, and price action might instead be a slow, steady grind up and up.

Of course, once we see $20k I expect it will be all over the news, possibly triggering another wave of retail FOMO. I’m not sure that it will have as much effect on the market since the market cap is actually a higher due to the block rewards emitted over the last few years. I’m probably completely wrong about this.

There’s also a chance that we’re moving into the next phase in bitcoin adoption: HODL FOMO.

If accurate, it would reduce the chances of a big drawdown, furthering the need to hold on. Still, I expect some sort of pullback. Many in CT are warning that this run up is happening too fast, and are hoping for a bit of a pause here now that we’re at $17,600. Better to let the market take it’s time than have a blow off top later. Still, I’d imagine some sort of resistance at $20k, so I’ve put in a limit order on my recent $GBTC entry that I hope will translate to the $19,800 level. If it hits, I’m hoping to to have another entry before we blast off, otherwise I’ll hold the funds to deploy elsewhere.

Where? Well I have noticed today that many of the crypto industry tickers had double the gains that $GBTC did:

I’ve got some value averaging protocols engaged for several firms, and I’m low on cash, so I’ll either need to liquidate some GBTC to free up some capital, or stop the protocol. I’ve set an expiry on the GBTC sale for Thanksgiving. Hopefully we’ll blow right past $20k while the market is closed and I’ll be able to close my position without selling.

Overally, my IRA was up over 6% today, while the major indexes were down one percent. I nearly had a five-digit day. So close. My point is that it looks like things are moving according to plan. BTC is on a run up, and it seems like every day I’m a bit closer to my goal of financial independence.

On top of this, President-elect Biden signaled that he will absolve up to $70,000 in student debt for everyone, regardless of income. This will wipe by debt completely. There are questions about how fast this will happen. Apparently he can do it via executive order, so we’ll see. One thing is now clear, that I will be making the minimum payment on my loans, of which the first payment is due in January.

What an exciting time!