Increasing your monthly payment could save you more money

I’m feeling like some kind of dad genius this morning. Elder came in my bedroom earlier and told me she did her bathroom and bedroom chores. “Good,” I said, and rolled back over, not ready to get out of bed. She walked off and a minute later I heard her unloading the dishwasher. This kid really wants her extra screen time, man. I told her if she does all her daily chores I would give her an extra hour. And she’s currently two-thirds of the way to her DadPoints goal, so I guess we’re getting a cat next week.

I was really happy with yesterday’s post about my trading performance and figured that a more accurate assessment was needed. I hate to say it, but I think I need to do some more work in Excel, to figure out how to group transactions and join several sheets together. I don’t know if it’ll work or if I’ll need to get more complicated and throw it up in Python (or Google Collab) but at the minimum I want to see what things look like when I remove long term positions like Amazon and NVidia.

Today I want to talk about something that I wanted to mention yesterday, but took out cause of time constraints: refinancing our mortgage. Missus and I were discussing it as part of our FIRE plan, so I reached out to our mortgage agent to see if it was worth it. The short answer is no, and it’s likely that, for most people who are looking to pay off their mortgage and pay less interest, simply paying more on the collateral is a better play.

We’ve been in our house for five years, put ten percent down and have a twenty five year fixed rate mortgage on the house. Our payment includes escrow for taxes, as well as mortgage, flood and property insurance. After the first year, the escrow estimate went down, and we’ve been paying the difference into the principal each month. The city assessment on our home has gone up more than ten percent as well.

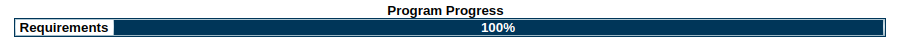

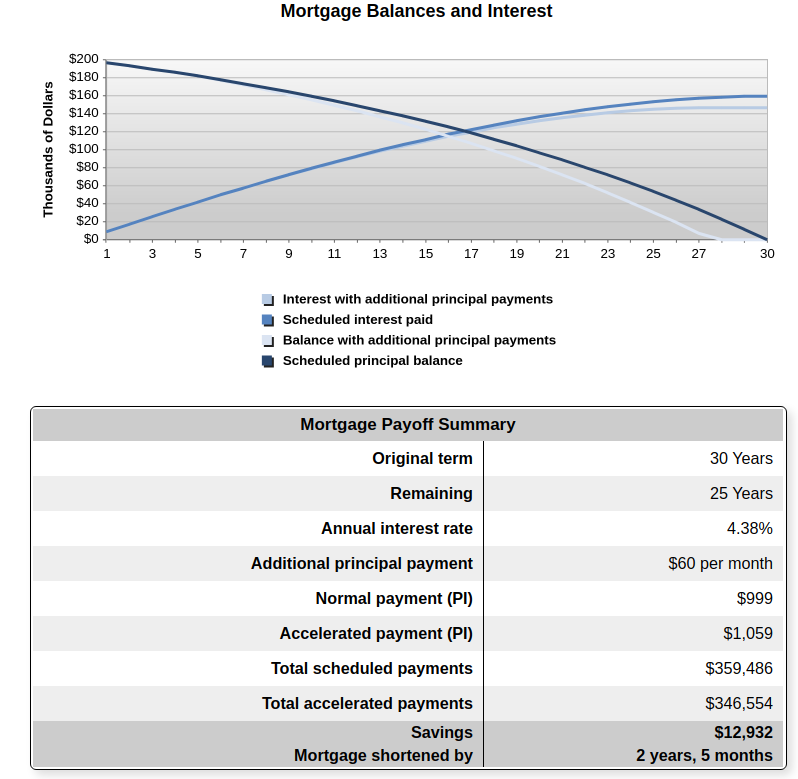

You can take a look at the this refinance calculator to see your own options, but our results weren’t very encouraging, only about $35 a month, or $420 a year. Considering that we would pay 1-2% on closing costs, we’d have to stay in the house for another seven years just to start recouping the money. And the total savings would only be about $8400 over the life of the loan. No sir. Instead, have a look at the savings we’ve gotten from throwing that extra $60 capital in each month. First, here’s a payoff calculator with a five year old mortgage with an original value of $200,000:

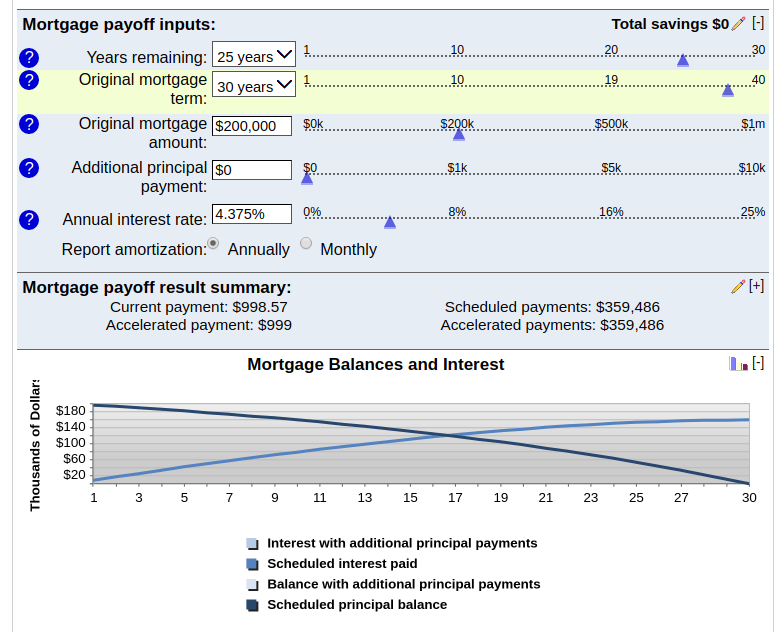

And here’s the result with an extra $60/month thrown on top of it.

Almost thirteen thousand in savings. That’s the value of compound interest, right there, folks.

Since we’re now under the 80% loan to value (LTV) on our home and are no longer required to carry mortgage insurance, I emailed our loan adviser and had him run the numbers for me, just to make sure I knew what I was talking about. They gave me several options, including a 20 year fixed with almost a whole percentage point lower rate. The savings? Sixty dollars a month. Now, while that does change the original estimate, we’re still talking about thousands in closing costs, which would take at least five years to recoup. And we can save three-quarters of what we would with a refi just by doing what we’re doing now.

So for now, we’ll just take the PMI payment and roll it back in to our principal every month, shaving over four years off of our original maturity date.

Before we bought this house, I had no idea how much I would hate the payment summary on my mortgage statement every month. The interest portion of the bill alone was enough more than I paid for my first apartment! It’s crazy. Thankfully Missus and I are on the same page, and focused on getting debt free and FIRE as quickly as we can.