Thoughts on Weimar, meme coins and the end of bullshit jobs

So ETH broke $4200 as the world has lost its mind over meme coins. SHIB is some multi-billion dollar token now, and new competitors are springing up left and right. Gas on ETH is the lowest I’ve seen in days, 180 gwei as I write this, but I still have yet to make any moves on mainnet in roughly a week. It’s just too expensive. My OpenSea listings remain untouched, and likely won’t fill since it’s just too damn expensive to do anything.

I think we go up from here. Sell pressure on ETH is likely to be non-existent for some time, given all of the staking options that are happening. Bankless has gone into this whole ultra-sound money thesis a bunch so I’ll not repeat it here, but Cochran’s tweet below is likely correct. NGU technology indeed. And I love that he lumps his investments into EVM-compatible and Solana. Confirmation bias indeed.

My thesis for this cycle has been that ETH would outperform BTC. When ETH hit $2000 I put a good amount of my retirement portfolio ETH into the ETH 2x FLI token, at $123. Today it’s at $420, and I’m sitting pretty. I’ll likely hold this position until ETH breaks this line, then I’ll consider scaling it back a bit.

Messari’s Ryan Selkis made a comment a while back that we’re likely to see a lot of “idiots” making more money than us this cycle, and he cautioned that it was OK and not to follow the FOMO. There’s plenty of money to be made this cycle, one just needs to keep their cool, follow their plan, and execute. There’s just so many people flowing into crypto this time round, there’s no telling how crazy things can get from here.

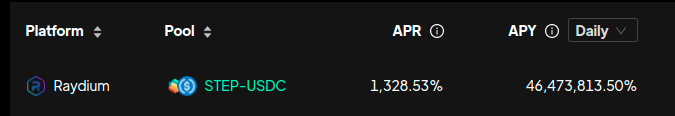

One thing that does have me concerned is the broader casino quality that’s going on now. I don’t know how much of the broader population is entering the space right now, but I think we might be in for trouble long term if we start minting millionaires left and right. I don’t know how many low-wage workers are winning the lotto with Doge and SHIB and all these other meme coins, but I hate to see the fallback once this bubble busts. I remember the feeling of anxiety and excitement that I felt during the 2017 run as I watched my four figures become size, but I also remember the anxiety and doubt that occured as the market corrected eighty percent over following six months.

There’s been a bit of fear-mongering among some conservative and libertarian media about people making more money on unemployment benefits and stimulus than they would make working at most jobs, and we know we’ve been facing a skilled labor shortage here in the US for some time. A good number of my clients over the years have been struggling to find skilled labor. HVAC techs are just one example I can think of. Now I’m seeing reports on social media of fast food restaurants closing down with signs taped to the intercoms that “no one wants to work here” or “people don’t show up for the jobs they signed up for”.

And I can attest that certain types of tech roles are hard to fill these days. Take mine for example. I’m basically forfeiting my position to work for daos or protocols or yield farming or whatever the hell I’m going to call it. Is this the future of work? Is the rise of SHIB and meme tokens going to spawn an exodus from productive labor? in the past I’ve pushed back against the idea that stimulus and UBI would lead to the mass exodus of labor from the market, at least a detrimental one. Sure a lot of bullshit jobs are going to be really hard to fill moving forward. No one wants to work for a minimum wage job when it takes three or four hours of labor to feed a family of four from the same restaurant.

After reading When Money Dies I’ve got a few doubts. So much of what that book describes in 1920’s Germany seemed oddly familiar to me when I was reading it, and each day that goes by seems to be like deja vu. The rush to speculative assets for example, the realization that it’s not the assets themselves that are going up in value, but that our money itself is losing value. In this case it’s not just the dollar, but all fiat currencies that are losing value against Bitcoin and other cryptoassets. We’ve already seen asset inflation in stocks and the housing market; used cars experienced a bubble last summer as stocks of new cars fell off due to factory closures; the price of lumber is still exorbitantly high due to home-improvement and new construction demand. Now, as the economy returns post-COVID, we’re seeing the beginnings of a bubble in energy stocks as demand meets a year of underproduction. Not to mention the shutdown of the Colonial Pipeline due to a ransomware attack that has led to gas station shortages.

We are in the beginning of the euphoria phase of this bull cycle, I would say. One recurring theme from When Money Dies stands out to me, it was that through the multi-year collapse of the mark in Weimar, things kept getting worse in an unending catastrophe, again and again and again. Crypto, with its charts and cycles, might be giving us a better view of exactly what’s going on. As the market cap of these coins go parabolic, we can always wonder when the pullback will begin, when the correction will come.

What if it doesn’t?