Dreams you can’t remember but keep searching for an answer

I’m not sure exactly why I’ve been having problems with my sleep schedule lately, waking up at 3AM in the morning has never been my thing, and I’m not particularly enjoying it. It doesn’t help that I get woke up by Younger, or that the cats like to stampede through the house, making me think that we’re getting robbed and spiking my adrenaline. I’ve always been a light sleeper, even since I was a teen. I could never sleep as long as my mom and dad were awake, and I could hear them watching TV or talking and getting ready for bed. I suppose that this is one of the reasons that I’ve always gravitated toward being a night owl. I’ve heard that some people with ADHD tend to be night owls as well, getting most of their work done in the hours when everyone else is quiet. It certainly works for me in the morning.

As my tinnitus has gotten worse over the years, I’ve taken to keeping a fan on, and more recently a noise machine. My wife has convinced me to start making a habit of going to bed at 10PM, and I’ll read a book on my iPad or dead trees for a bit before going to bed. Sometimes I’ll take a melatonin, but I’m wary about over using them because of the tolerance, and because of the fact that lately when I take them I wake up at three in the morning and can’t go back to sleep.

I am one of those people who seem to get by with less sleep than most people. Certainly less than my wife, who would be happy to sleep twelve hours a day if circumstances permitted. I think it’s one of the reasons that our relationship has worked so well over the years. She liked to sleep, and I got to stay up late playing video games. At least before the kids came along, anyways.

So this morning I woke up from a dream — something about an alien invasion and trying to fight back against the oppressors. We were on the run and came to a dead end in a canyon. We were trapped — and I woke up. I tried to go back to sleep but then the cats knocked something over or made a noise, maybe it actually came from outside, but a part of my brain yelled HOME INVASION THEY’RE COMING FOR YOUR CRYPTO and then my adrenaline spiked and started running though response scenarios.

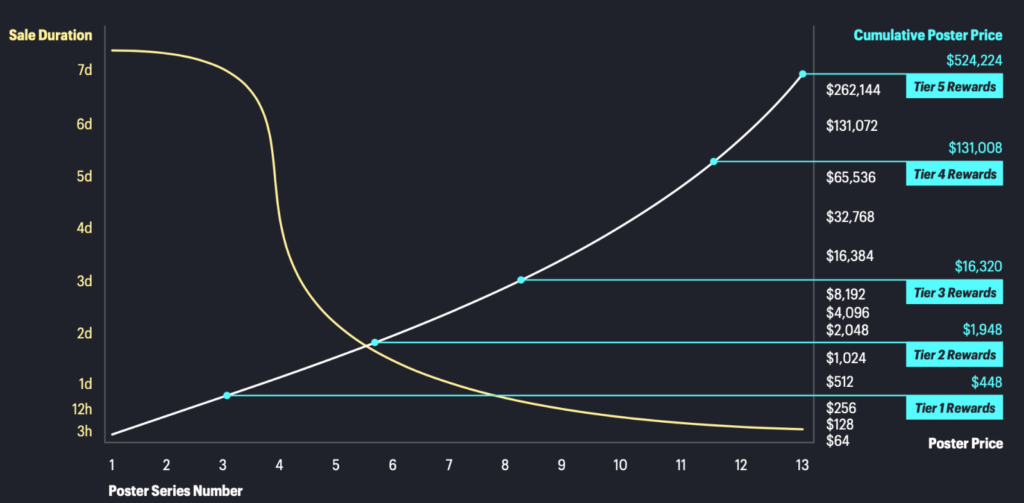

Meditation has been helpful in quieting things down, but most of the time I fail to fall asleep, so I lay in bed, until there’s some thought that won’t let go and I finally give up. Of course this morning it was related to the dao proposal that I’ve been working on for two days now, trying to come up with a proper incentive scheme to incentivise early participation. So I got up, boiled water for my tea, medidated, had some ideas, gave sleep one more shot on the couch and now I’m up for the day. It is twenty after six. Such is my life these days.

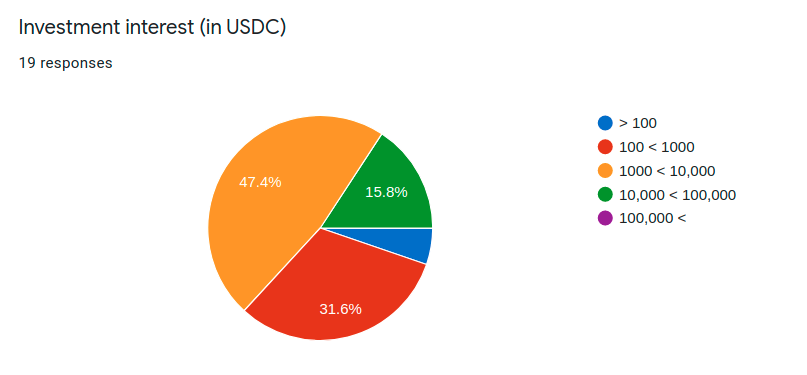

So I’m very close to finishing the dao proposal. I have some more writing to do, then I’ll be ready for some more community feedback. Yesterday I spoke to a computer science student in Singapore. They “manage equities” for their family and said they were looking at a minimum investment of fifty thousand dollars. We talked for an hour, and I was able to secure a promise to move forward with the broad plan that I described. So I just need to finish writing out those broad strokes so that I can give everyone a day to join before the sale launches.

All this work with DaoHaus on xDAI and with the Gnosis safes has really given me some great ideas. Even beyond the NFT sale, this may be a great way to organize the family business. xDAI would mean that the wallets would be easy to manage, share wise, and I could just run everything from a Gnosis safe. I could setup my dad and brother as owners and we could just have a one of three multisig on it. Might work out beautifully, depending on gas costs. Might get a bit more complicated later on when we start , but I think it’s the solution that I’ve been looking for.

Side note, I ran across this firm, Korporatio, that sets up offshore entities in Panama and other locales. The created entities are managed through on Ethereum through an interface that looks strikingly like DaoHaus. Too expensive for me to consider right now though.

I’m going to be very happy with myself after the NFT dao is launched. I’m still excited about Star Atlas itself, my conversation with the student from Singapore touched on Solana a bit. Since the game will run on Solana, and most of the game’s underlying infrastructure will be publically accessible, it means that we’ll be able to write our own programs to interface with it. It’ll be like hacking into the Matrix from onboard the Nebuchadnezzar. We should be able to access the game’s API and manage things from outside of the official game client. Fun. I was skimming the docs for Solana yesterday, and it looks like it’s going to be a long road to that one.

From what I can tell, there are so far no dao projects active on Solana, so hacking together something that resembles MolochDao looks like it’s going to be our first goal if we are going to bring SAIA Dao to fruition.