So yesterday was a pretty good day.

No one was on the team call yesterday, so I hung up quickly. It was good Friday and our office manager was on holiday. Bossman called me shortly after to check on me. I had a couple tasks to wrap up two projects, there wasn’t anything urgent going on. He asked me about my Easter plans, I had none. I started thinking about our beach week in August, and dream plans to fly to Costa Rica in the winter. You know you’ve got two months left to replace me, I told him. Ya, he said. It seemed his tone deflated instantly. Now that I had said it, there wasn’t much else to talk about, but my mouth went on for another minute while my mind wandered. We hung up and I sent an email. I don’t think I did any more work the rest of the day.

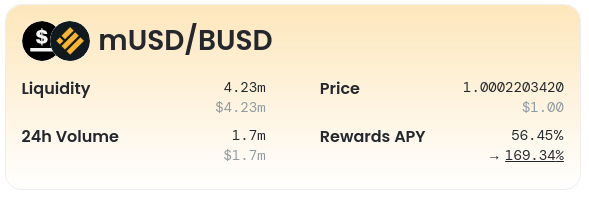

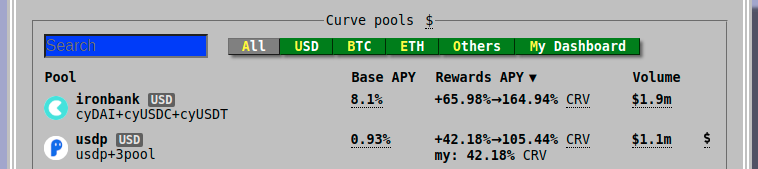

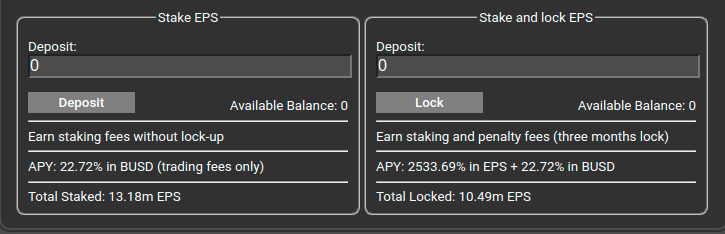

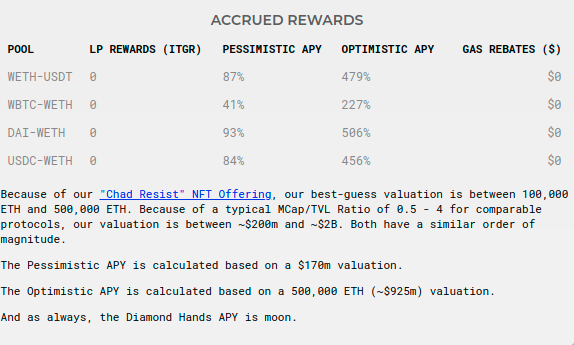

I spent the day flitting through Discords, Twitter, watching charts. ETH hit two thousand, so I put a one-percent allocation into FLI, a 2x leveraged ETH token. BTC just seemed to ignore everything, as it has been doing for days, trading just under sixty thousand, toying with us all. I’d been looking for stablecoin yield for days, trying to figure out where to put the last couple allocations of USDC. I had miscalculated my boost on the mStable pool, and wound up getting none for all my trouble. I decided to offload the majority of my safe A tranche to my Voyager account. It’s 9% right now, and it would be liquid if I needed it. No unstaking fee or gas costs other than a standard token send. Once BlockFi actually starts offering their debit card I can move funds there for groceries and things.

At some point during the day I saw a Tweet for the Bitcoin2021 conference in Miami the first weekend in June. Hmm, I thought to myself. I’ll have left my job, I’ll be vaccinated, and my birthday will be the following Monday. Seems perfect. Missus an I have a bunch of air miles from one of our credit cards that we really want to use as well, so we don’t even have too worry about airfare. I checked ticket prices and airfare, hotel costs, then went up to ask Missus about it with a huge grin on her face. With the kids? she asked, annoyed that I was bothering her with one of my far-fetched plans. I’ll call my mom then and see if she can watch them.

Sure, she said, rolling her eyes at me. My mom hadn’t seen the kids but once since COVID and always seemed to have better things to do than come see her grandkids. Call you mom to come watch the kids. She assumed that was the end of the conversation.

I called my mom. She was actually free that weekend and said she would come down and watch the kiddos while we were gone. I was actually suprised.

A phone call with my mom a few minutes later and was running back upstairs practically jumping. We are going to Miami! We spent a few minutes working out plans, (Bitcoin2021 for me, spa day for her, after party for both of us,) before her anxiety came back.

I’ve been burned by you before, she told me referring to a thirteen month stint on unemployment that I did before we had kids. I spent most of it smoking weed and playing video games.

That’s not going to happen again, I told her. Nothing’s going to change. I’m going to be right back down here, every day at 9AM working on other projects. I had already been in contact with several projects that week that needed technical writers, support staff, and developers, I would be busy one way or the other.

What about our mortgage and your student loans?

I’ve got eighteen months cash on hand, if I have to pay the mortgage off on June 1 to make you happy, I’ll do it. I had enough BTC on hand to do it right then, but I had told her so many times that the opportunity cost to sell now is just too great. I don’t know how much different I’m going to feel in June, but I’m mentally preparing myself to cash out half of my IRA if I need to. Student loans aren’t even due until September, and if I need to pay that off in a lump sum then so be it. I’m holding out till then. I assume Biden will erase some of it by then, or do some sort of plan to kick the can down the road.

I saw a shift in her demeanor, a little tilt that I was winning her over. She’s been having a hard time accepting what I’m planning, and every day for the last two weeks or so has been a series of skirmishes as I move forward with my dogged determination. That’s the dream, I had told my mom earlier. Don’t let the dream become a nightmare, she had responded.

I was ecstatic the rest of the day and we put the kids to bed late.

So today I plan on doing my usually monthly bookkeeping tasks for the family accounts, Moving the girls’ LendingClub accounts to their BlockFi via my bank, and balancing the joint house account. I’ll need to book those tickets, after I figure out how to pay it. Travel and lodging will be covered by air miles, but I’ve also got to book those Bitcoin2021 tickets. There’s a $50 discount if you pay with Bitcoin.

Not today, though. Not today.