I’m a degen now.

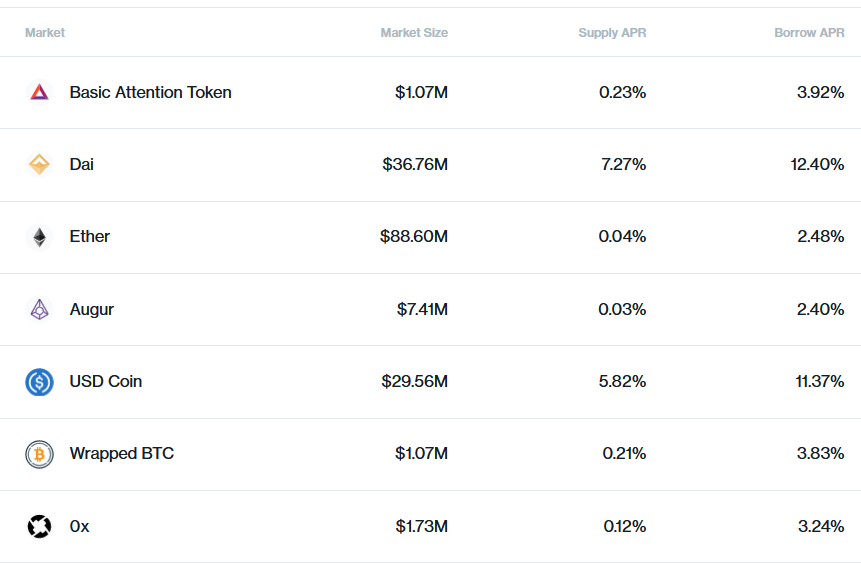

I finally took the plunge, after a couple of test runs with Yearn, Sushi, and Harvest, and finally dumped a significant amount of capital into yield farming. Bankless published an excellent guide that I read this morning, and since the yETH pool is still closed, I decided to dump my stash of USDC tokens into Curve’s sBTC pool, and then staked it on Yearn where it’s now gaining upwards of forty percent ROI. We shall see.

The entire process was relatively painless considering the stress I went through with my previous forays. Zapper made the process even more so. It did most of the heavy lifting to get my Curve tokens, then I just had to stake them on Yearn, which was another step. And the gas used was only about half of what I was expecting, so yay.

Time will tell how long this DeFi madness can go on. I’ll probably take a breather for a bit and watch what happens. This feels like a pretty big step but I don’t want to go crazy right off the bat. I’m still reading through Mastering Ethereum, and it’s obvious that I’ve got a long ways to go toward understanding how all this stuff works, so I’ll just take it easy and get into it the same way I did with crypto: slowly.

There’s a first mover/early bird advantage to these markets, but I shouldn’t expect to keep getting lucky. Capital preservation is the name of the game. I’ve been so focused on it lately, and have been very aggressive with my equities positions. In addition to Overstock last week, I also had Tesla and NVidia stop out on me this week, so I’ve got a lot of cash available in my retirement account that I can deploy on more speculative bets. (Like I haven’t dumped enough on mining companies already…)

I’m continuing my value average program, but have also put stops on some of the ones that are running hot. Take profits. Hopefully that won’t come back to bite me if we actually get inflation. I’m just waiting for a broader pullback.

I’m keeping an eye on the ETHE premium. I’ve opened a small position, set some stink bids, and will scale in as I can while protecting my capital. The last week or has seen some crazy runs, I swear I must have gone up thirty percent and down fifteen in the last month. It’s insane.

If I’m going to make a living out of this then I need to keep calm and remember how to protect my positions. My equities trades are tax-exempt, but my crypto gains are going to be taxed like hell if I make any big moves. So far I’ve avoided liability, since my trades have been at a loss, and I haven’t opened any positions that have required stops yet. We’ll just wait for the market, buy low and ride it high.