I had a couple calls earlier this week from a couple friends who want to increase their bitcoin holdings. One is an individual investor, and the second wanted to know how to best purchase as a group. I know this is only anecdote, but I think it goes to show that this latest pullback is being seen as a buying opportunity by many. This discussion will focus on Bitcoin and Ethereum-related assets. I’ll cover the individual case first and build out from there.

Dollar cost averaging

My first friend, R, is a successful professional who has less than one percent of their net worth in bitcoin, which they currently have in a Coinbase account. They want to increase their exposure with a five-figure purchase. Timing is important for R, they know we’re still early from a long-term, but worries that short term price fluctuations might give them a bit of stress. What I am recommending to R is that they open a BlockFi account and implement a dollar cost averaging setup to scale into a position over the next six months.

The benefit to using BlockFi is two-fold. First, USD funds on the platform are currently earning 8% APR, and the interest can be paid in BTC or other cryptocurrencies. Secondly, BlockFi allows recurring trades, which means R can set it and forget it while their fiat is converted to crypto. Six months from now, they can either re-up their cash allocation, or move funds to take advantage of more decentralized, on-chain solutions.

Exchanges

BlockFi, for all its benefits, has a couple drawbacks which make it ill-suited as a primary exchange for power users. It’s not really built for traders, and is only really good for the occasional swap. Also they discourage withdrawals from the platform with only one free withdrawal per month. Additional ones can run as much as thirty dollars. Plus they can take at least one business day to process, so woe to you if you need to move funds on a weekend. So you’ll need to open an account with a full-fledged exchange.

My wife recently asked me which exchanges I use to convert cash to crypto and my response was all of them. Literally. It’s hard to make a recommendation here as a lot depends on individual circumstances, like which tokens you want to trade, how you’re moving funds (wire vs. ACH), and your familiarity with trading interfaces. On the simpler end I’d put Coinbase, Voyager, and Gemini, with Coinbase Pro, Gemini Pro, FTX and Kraken on the other. Realistically, you’ll probably want to open accounts on at least two exchanges, one as a backup.

As a security precaution, you’ll want to make sure you set up two factor authentication on your account. Do not use SMS messaging as your phone’s SIM can be spoofed, use an app like Authy or Google Authenticator instead. And as an extra layer of security, you may also want to set up new email addresses for each exchange account as well. Using different email accounts other than your primary one will protect you should it get compromised.

Self-custody and hardware wallets

While centralized exchanges are the primary fiat on-ramps to the crypto ecosystem, there are custodial risks associated with them, hacks and outages being the primary ones. Most crypto-diehards will no doubt be screaming not your keys, not your coins at me or anyone else who suggests keeping large portions of your funds on BlockFi or any centralized exchange. Self custody is the way, and while there are a number of softwallets available for phones and computers, a hardware wallet is the way to go for significant sums of coin. I recommend a Trezor for most people, but anyone who plans on participating in DeFi, daos, NFTs or whatever else on the Ethereum ecosystem might want to take a look at the Lattice1, which has a large touchscreen for inspecting smart contract calls, as well as a host of other useful features. I don’t recommend Ledger products unless you plan on dealing with Solana, as it’s the only choice currently.

An important note about purchasing hardware wallets: they should only be purchased from the vendor, and never from secondary markets. It’s recommended that you use an alias and a drop box for shipping to prevent your personal details from being exposed. Make sure the anti-tampering seals are intact on all the packaging. And make sure you generate your own private keys, never use any that have been given to you by someone else, and never record them in an electronic form. The Trezor will come with several slips for you to record your seed phrase, and the Lattice1 allows you to store your keys on a password protected smart cards. Either way, make several copies and store them securely in different locations to protect from loss.

Remember, if your device is destroyed or lost and you don’t have your private keys, or if anyone else gains access to them, your funds are lost forever. There’s no password reset button or customer service team you can contact if you forget this very important point.

Institutional accounts

If you’re buying crypto for a business, you’ll want to open an institutional account with an exchange. This could be for your LLC or partnership; I have a couple tied to my checkbook IRA account. You’ll need articles of incorporation as well as certificates of good standing from whatever jurisdiction that you’re registered in. You’ll also need to complete KYC for any authorized members of the entity that will have access to the account.

Now you’ve really got two ways you can go here if you are a corporation or business that wants to get into crypto. A lot of the big hedge funds rely on custodial accounts for their holdings, as dealing with self-custody is too much of a hassle for them. One of the most popular custodial firms is Coinbase, but I don’t have experience here to tell you much more. I can tell you that many of the crypto IRA products out there are basically built on top of Coinbase Custody, which charges an annual custodial fee as well as what I consider relatively high trading fees. You’ll also be limited to the assets that Coinbase has available. There are other custodial firms available, but again, I have no experience to speak of here.

Multisigs

This section is geared toward groups of people, whether they’re part of a formal corporate entity, or even an informal one. I’ll describe a couple ways that assets can be managed in a trustless way, that is, how a group can share management of assets, without allowing any one individual to have complete control of them.

The first, and most common is called a multi-signature wallet, or multisig for short. It’s a wallet in which a certain number of owners are required to sign off on a transaction before it can be approved, commonly referred to as m of n schemes, where n is the number of private keys associated with the address, and m is the number required for a valid transaction. These are most commonly configured as 2 of 3 or 3 of 5 setups, although you can have 2 of 2 or even 8 of 8 if you wanted to. There are a number of firms that provide bitcoin-specific multisig services, and it can also be configured via a Trezor hardware wallet and the Electrum desktop application.

There are no hardware based multisig solutions for Ethereum, although on-chain smart contract solutions do exist. The most popular is Gnosis Safe. With Gnosis, an on chain vault is created, and the m of n scheme and owners are specified. ERC20 tokens and NFTs can be sent to the vault address, and Gnosis has several plugins that allows the vault to interact with a variety of apps, such as Uniswap or OpenSea. Any owner can propose a transaction, and once the requisite number of owners have approved it it can be transacted on the Ethereum network. Many of the top defi projects on Ethereum use Gnosis vaults to manage their treasuries, and it’s a relatively trivial operation for less technical owners to approve transactions.

Other on-chain solutions

Gnosis is probably the most robust solution for a formal or informal group that is comfortable with a centralized, custodial solution. There are two others I’ll mention that might be more suited for other applications or groups, one that is non-custodial, and another that is decentralized.

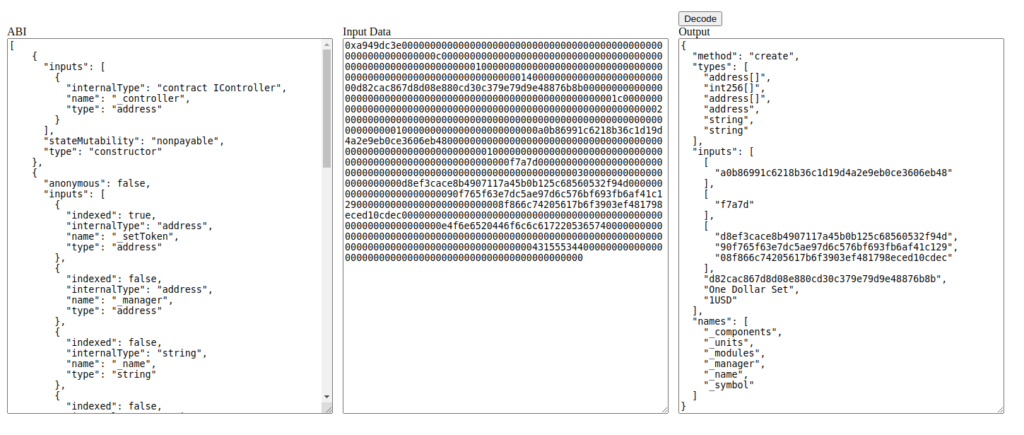

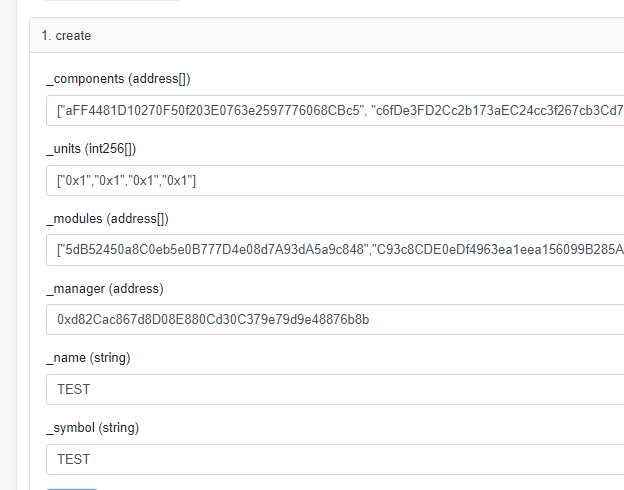

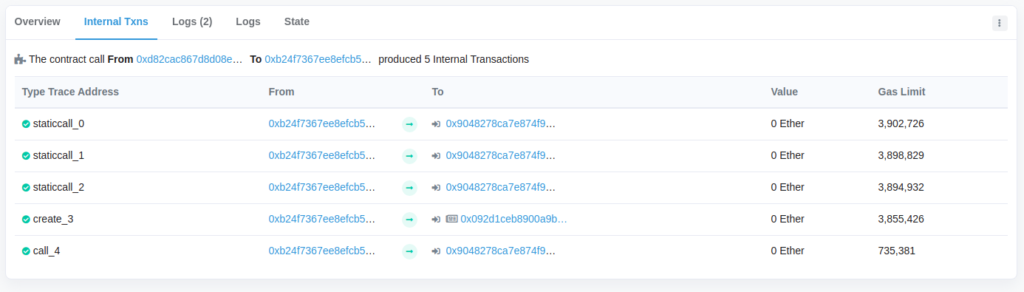

The first is called Set Protocol. A Set is akin to a mutual fund, and can be created with anywhere between one and twenty assets within it. Users can issue Set tokens by providing assets to the Set, meaning that the value of each token is backed by the assets within the Set itself. They can’t be created out of thin air. The Set manager can perform a number of operations with these set assets, such as trading them for other tokens or providing them to a number of DeFi protocols. These actions are somewhat limited compared to what you can do with a Gnosis vault. While the manager does not have direct access to the funds in the Set, there are a couple ways that a manager can potentially exploit funds in the set, whether through changing the management fee or trading into a illiquid shitcoin, the manager address can be assigned to a Gnosis multisig for additional security. We used Set Protocol for the Homebrew.Finance $MUG NTF Fund.

The last one I’ll mention is DaoHaus, which is used to manage decentralized autonomous organizations, or daos. Daos are basically on-chain shareholder corporations, and are useful if you want to create a trustless organization. Users can deposit into the dao in exchange for voting shares or loot, both of which grant proportional ownership of funds in the dao’s bank. Many of the popular daos on DaoHaus are venture funds or non-profit/open source grant foundations. Users can create funding proposals, the membership votes, and funds are distributed accordingly. Managing a DaoHaus can get a bit complicated, but it can also be combined with a Gnosis safe to provide more accountability. Additional development on DaoHaus minions, or associated smart contracts, continues to add more functionality to the system. We are using DaoHaus to manage membership in SAIADao.

Wrapping up

One quick note about on-chain Ethereum solutions such as Gnosis and so forth: gas fees. Congestion on the Ethereum network lead to some pretty high transaction fees over the last few months. It cost me over $500 to create the $MUG Set, back in March, with trades costing over $150 each. Creating a Gnosis safe cost me over a hundred dollars earlier this year after gas had come down, but the vault overhead does add some overhead to transactions. I wouldn’t recommend them unless you’re dealing with several thousand dollars worth of funds. Thankfully, the release of other Ethereum-compatible sidechains such as Polygon and xDAI are making relieving some of this pressure, although a full discussion of this will need to wait for another day.

Hopefully this article is helpful for others who are looking to increase their exposure to Bitcoin or Ethereum-related assets.