There are certainly worse things to wake up to:

Cryptotwitter has been full of anticipation the past few days. The bitcoin halving is just days away, and people are going mad with predictions on how price action will go. Is the halving priced in? Will there be a post-halving dump? Will less-efficient miners get priced out of the market?

On top of that, QE actions by the fed (money printer go BRR) has everyone convinced that $100,000 BTC is not just possible, but is very probable at this point. Some are predicting it before the end of the year, with others on a more conservative projection between now and the next halving.

Personally, I’ve been watching this upward channel curve for about two weeks now.

There’s a couple of important trend lines here to note. We’ve just breached the mega-dump that took place March 12. I’ll be looking to see if we breach the upward channel and test the next resistance at 9200. The green and red lines running up from the left is the multi-year trend line from August 2016. Getting back above this would be very significant, and would indicate that BTC has fully recovered from the COVID panic. This trendline intersects the higher curve on May 31st.

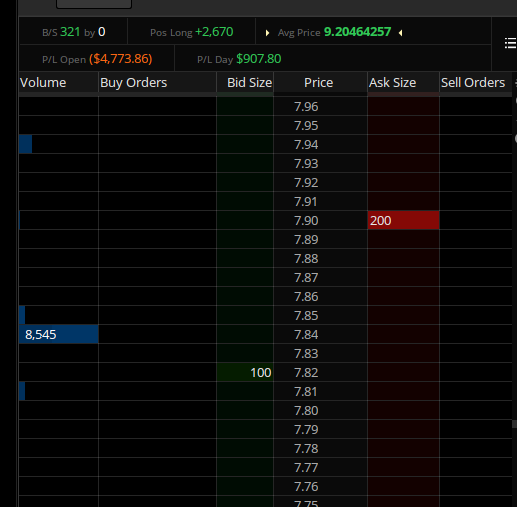

The news feed in Trading View is already full of coverage about this event; most of CT hasn’t woken up yet I’m guessing. Taking a look at arbitrage opportunities for trading with GBTC shows a couple opportunities. The GBTC estimator shows a price of $8.86, there’s been some pre-market activity at 8.75, which would have been a maximum of $111 in potential profit. It looks like most of this would have been taken by fees, as there were several orders for 200-300 shares.

Now that the timkpaine/TDAmeritrade project is moving forward with websockets, I’ll be adding additional functionality to my estimator. Right now it only pulls yesterday’s equity data and crypto markets via a REST call. With websockets, the program will be able to monitor price action, and take action on any deviations as they occur. This may take me a while, since we still need to develop the TDA functionality, integrate the new CCXT library, and figure out how to do asyncio calls properly. The opportunity here isn’t huge, but will make a good demonstration of my coding abilities. And if we make $20-100 day on moves like these, then that’s a bonus, right?