Introduction to cryptoassets for traditional investors

Sometime in the past few weeks, after Microstrategy and Square announced that they were holding $BTC as a treasury asset, someone put together BitcoinTreasuries.com as a way to track other public and private companies that have exposure.

Earlier today I checked the list and noticed a new name on the list, Bit Digital ($BTBT), which lead to a conversation on Twitter which I felt needed explanation beyond the two hundred and eighty character limit. So this post is squarely aimed at traditional equities investors who are trying to understand crypto and the industries around it.

Getting started

First off, if you want to understand Bitcoin, I recommend The Bitcoin Standard (affilliate link). I’m not the biggest fan of the author, but the book does a good job of explaining things despite the tone. The Nakamoto Institute has a crash-course as well that is probably handy, although I haven’t read the entire collection.

Other resources that I’ve found helpful in the past includes: Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond and the HashPower series by Invest Like The Best’s Patrick Oshaughnessy. Laura Shin’s Unchained podcast is a great source of current news about what’s going on in the space. And one of the best minds in the space is Andreas Anotonopolis, who has written numerous books on Bitcoin and Ethereum.

The current recommendation that I would give to investors coming into the space is to convert between one and five percent of your current net worth directly in BTC. Dollar cost averaging is perhaps the best strategy to use instead of a lump purchase, due to bitcoin’s volatility. Coinbase and Gemini are two fiat on-ramps that I recommend, but there are more springing up all over the place, RobinHood, Square, and now Paypal. If you plan on investing more than a couple hundred dollars, however, you’ll want to invest in a hardware wallet and use an on-ramp that will let you withdraw your coins to your own wallet. There’s a lot to cover here, more than I have time for today in this post.

In general, most OG crypto people follow the maxim “not your keys, not your coins”. The entire premise around bitcoin is that of self-sovereignty, and entrusting your funds to a custodial entity, such as onramps or exchanges, goes against this ethos. That said, there are places where it can’t be avoided.

Crypto exposure in equity markets

While I have been building up my crypto positions over the past few years, I also have a larger IRA that I’ve carried over from 401Ks accumulated over two decades in traditional corporate jobs. (I cashed out my traditional brokerage account for BTC last cycle.) So I’ve spent the last couple months trying to find exposure to crypto markets, where I can take advantage of tax deductible deposits and tax-free capital gains.

Grayscale

The most direct exposure to crypto in the equities space for US investors is via Grayscale Investment’s Digital Trusts, mainly the Bitcoin ($GBTC) and Ethereum ($ETHE), and to a lesser extent, the Digital Large Cap fund ($GDLC), which is a basket of BTC, ETHE, and a couple other alts. I do not recommend the Ethereum Classic trust ($ETCG), and the other single-asset funds are not available through standard broker accounts yet.

Until there is a straight bitcoin-derived ETF, which may be a long way off, Grayscale is probably the best bet for exposure to Bitcoin. There are a few things to keep in mind though. Grayscale operates with a two percent annual fee, and the bitcoin per share of GBTC is currently at 0.00095320, according to their website. However, the Grayscale vehicles trade at a premium to the underlying value of the BTC in the trust. The GBTC premium is currently at twenty percent, and the ETHE one is at fifty, although this is near an all time low.

Other equities

Let’s take at the companies listed on the BitcoinTreasuries page. I’ll mention the ones that I have positions in: RIOT, HIVE Blockchain (HIVE/HVBTF), MGTI, and Voyager (VYGR/VYGVF). I also have two other positions not on the treasuries list, Marathon ($MARA) and DPW Holdings ($DPW), that have exposure to BTC as well.

A number of them are involved in mining activities, so let’s break that down.

Bitcoin is the world’s first truly scarce asset. The mining process, as it’s called, is actually a competition to see who can win a mathematical contest to mine a new block, and win the block subsidy, (currently 6.25 BTC) as well as the transaction fees. There are a couple analogies that one can use to describe this, but I like to use coin flips.

Imagine that you and I are in a contest to see who can flip ten coins in a row and have them all come up heads. It may take the two of us a while to do that, but as more people join our game, the amount of time before someone ‘wins’ will decrease. This is essentially what happens with bitcoin, but in this case the game is a contest to perform a cryptographic hash function using the last block and a random nonce as inputs. In this case the winner is the one that can generate a hash with a sufficient number of zeros in the front. This process is known as proof of work (PoW).

Another critical component of the bitcoin algorithm that makes it work is the difficulty adjustment. This adjustment, built into the bitcoin PoW protocol, is triggered every 2016 blocks, or about every two weeks. It changes up or down to keep bitcoin’s blocks coming every ten minutes on average. As more miners enter the blockchain network, this adjustment ramps up. As you can imagine, this leads to a race for hashpower, as manufacturers put out faster, more power-efficient hardware to mine faster.

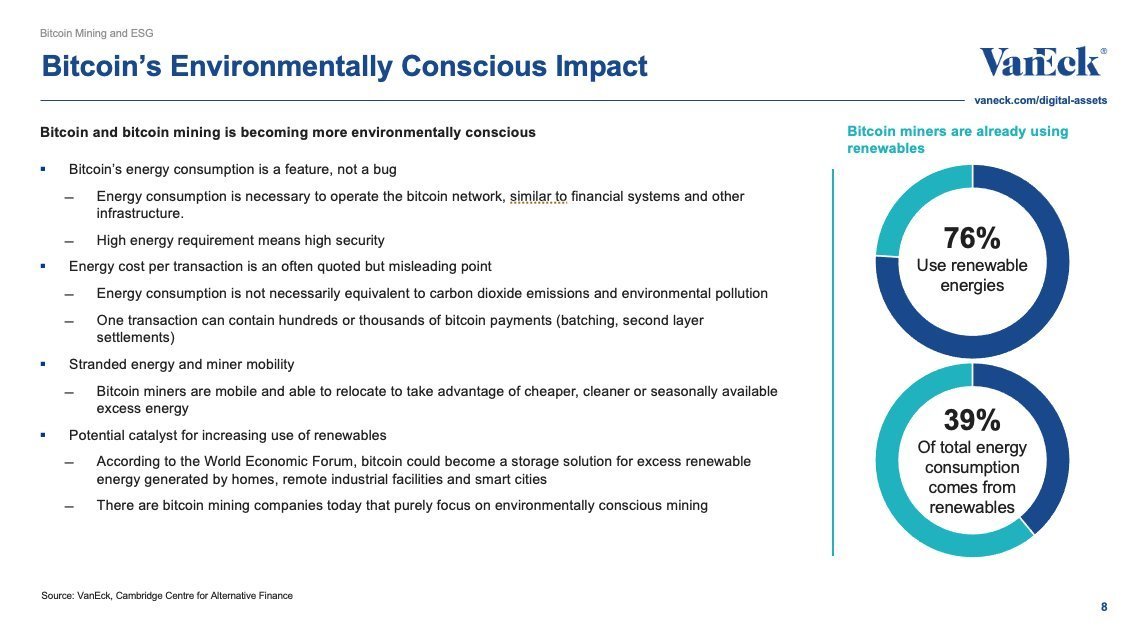

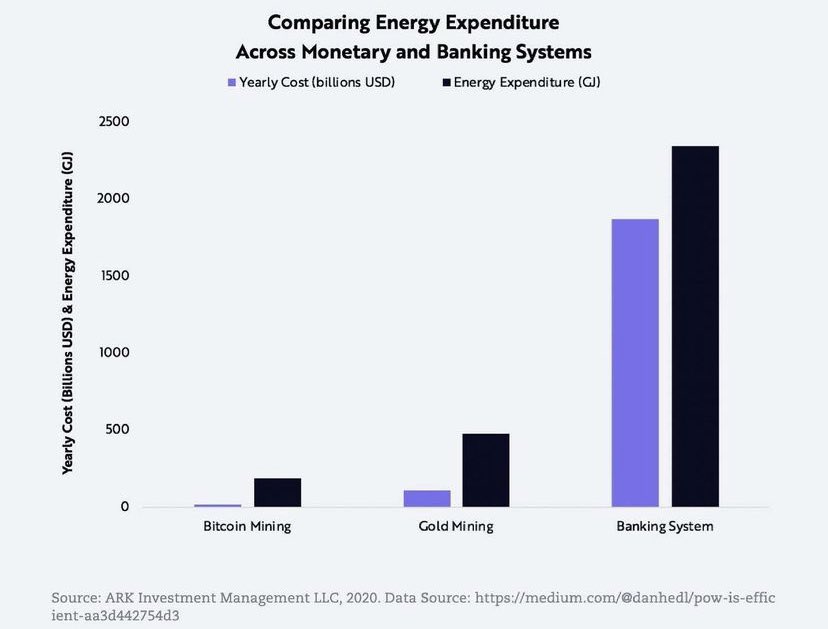

So when someone asks what the “intrinsic value” of bitcoin is, I usually point them to the capital cost of the hardware securing the network, as well as the cost of electricity used to run those machines. There’s a lot more detail to go into about the mining process, especially with regard to the stock to flow model and halvening process, for example, but that will have to wait for another post. What I will mention is that we just had the second largest difficulty adjustment in history, as a number of Chinese mining companies shut down their equipment. Most of them were taking advantage of low-cost hydroelectric power during the recent rainy season, and are relocating due to higher prices. The takeaway here is that it will mean better returns for others who are still mining on the network.

One last note about mining companies. There are number of cryptocurrencies beyond Bitcoin that can be mined. There are forks of bitcoin that can be mined using the same specialized ASICs, although I recommend staying away from them, and there are other currencies that use traditional graphics cards like those used for video games, called GPUs. I mention this because there have been ASIC mining operations that focused on non-bitcoin during the last bear cycle that weren’t able to stay afloat.

Generally speaking, I don’t recommend exposure to any of these mining companies unless you’re very familiar with the space, and/or as is my case, looking to take a gamble that one could see an outside return during a BTC bull run. Caveat emptor.

Other cryptocurrencies

As I alluded to a moment ago, anyone can take the Bitcoin source code, modify it, and create a new bitcoin fork. There have been many attempts over the years, and I won’t name them. I generally stay away, and agree with most bitcoin maximalists that the original BTC is the best store of value out there. That said, there are other blockchain projects out there that have different aims and use cases. The only one that I’ll mention is Ethereum, which is a smart contract platform, and allows one to program applications on the blockchain and have them run in a decentralized, autonomous way. It’s been around for several years, and is the king of the Decentralized Finance (DeFi) space, which is generating huge interest amongst developers and finance types. It’s the main focus of my activities right now.

There is a lot going on with Ethereum right now, so I recommend caution before taking a position in it, at least until you understand the landscape. I advise even greater caution with other cryptocurrencies, or altcoins. I’ve been in the space since 2014, and have spent hundreds of hours researching various projects, reading white papers, and the number of scams, hacks, contract failures and rug pulls that I’ve seen in this short time is staggering.

Fiat onramps like Coinbase, Gemini, and others have been adding other cryptoassets to their platforms over recent years, mainly cause the demand is there, but anyone who thinks that any of these tokens will see price appreciation anything like bitcoin over the last four years are probably going to be in for a rude awakening. Are double digit gains possible? Sure, but I am not betting anything other than a small stake, especially if we’re on the cusp of a BTC moon run.

A note about trading pairs: a few years ago, your owly onramp into cryptoassets from fiat was into bitcoin, which was then traded for other altcoins. As a result, most traders tracked their performance by the BTC price. The rationale here being that if you lost value in BTC terms you would have been better off not trading. As fiat on-ramp have made it possible to go directly from USD to other tokens, some have stopped this practice, although I still stick to it. More recent trading and market making platforms have introduced swap mechanisms which make it possible to go from one token to virtually any other, performing whatever third or nth level conversions necessary in the background. Since my long term goal is to accumulate BTC, not USD, I still track all trades via the BTC pair.

Stablecoins and Tokenization

Another trend that I think is worth mentioning is that of stablecoins and tokenization of hard assets. Basically, fintech companies have figured out that they can use a type of Ethereum asset called an ERC20 token as a digital dollar, and transmit these tokens over Ethereum as an alternative to the traditional fiat settlement system in traditional finance. Ethereum transactions settle in as little as twelve seconds, compared to ten minutes for bitcoin, and days for banks. These tokens go by the name Tether, USDC, DAI, or GUSD, and are supposedly backed by physical reserves of the various issuers. There is a lot going on in this space, I recommend you checkout The Crypto-Dollar Surge and the American Opportunity if you are interested in more.

Lastly, I wanted to mention asset tokenization, cause it will likely be huge in the coming years. Stablecoins are basically tokenized dollars, and we’re already seeing companies tokenize traditional equities on blockchains, and real estate is right around the corner. I bring this up cause I was asked directly about Vemanti Group’s plan to offer a gold-backed crypto. I’ll only speak in general terms, since I’m not familiar with Vemanti. I have seen a host of gold-backed crypto projects in my day, and I’ve got a general unease about the concept.

While there’s generally nothing wrong with gold-backed crypto per se, the whole idea as bitcoin as an alternative to gold makes me question the motivation behind such aims. The whole point of bitcoin as an alternative to gold as a store of value has to deal with gold’s difficulty to transport, as well as seizure risk. It seems like a step backward to me.

The main risk here that I see is one of custodial risk. Bitcoin, Ethereum and blockchain technology as a whole are decentralized projects, and one’s which allow trustless interactions between adversaries. When you start talking about asset tokenization, you’re putting trust in a third party. Tether for example, has been highly controversial because of accusations that they print more Tether than they actually have reserves for.

Color me skeptical about gold-backed crypto projects. Again, there’s nothing wrong with it in general, but for the most part, I think that the more people understand how bitcoin works, the less interest they’ll have in gold in general. Again, I do think there is a huge opportunity in tokenization of assets, and I’m looking forward to see how this plays out in the future.

TL;DR:

To sum up, I hope this serves to answer some questions traditional asset investors have about the crypto space. I truly think it’s the greatest opportunity of my lifetime, and that we’re on the cusp of widespread adoption by retail, institutional and sovereign investors that will be unlike we’ve seen. The tech is moving super fast, and truly understanding Bitcoin requires a fundamental shift in thinking about money and economics, especially scarcity.

Again, the best exposure is direct exposure to BTC, preferably in self-custody, but getting started with an institutional custodian while you figure that out is ok. It’s how most people start. There are a number of new instruments popping up for retirement or institutional accounts that we didn’t cover, Grayscale is probably the best option out there for those getting started.

Once you understand the technology, good luck to you, cause I don’t know anyone that has invested the time to make it that far that has ever gone back. It’s a whole new world. Please do your own research before you make any significant investments.

Hopefully this helps! If you have any questions, feel free to hit me up on Twitter or leave a comment.