I came across a request last week from someone asking for help writing up an intro to crypto for traditional equities investors. I offered to help, thinking that I had already done most of the work, but it soon occured to me that I hadn’t written anything aimed directly at people new to the space. So, let this be a quick introduction to a few things that I think anyone coming over from the space needs to know. This won’t be an explanation of bitcoin or blockchain, or even DeFi, as there are numerous resources out there.

My background is in tech, and I’ve done well over the last twenty years, investing in tech companies for the long haul. I caught all the FAANG plays before it was cool, and have made some missteps over the years, either being wrong with India and China plays, or being to early, like with 3d printing or pot stocks. For of my career, I followed the advice of The Motley Fool, only buying stocks that I was interested in holding for five-plus years. I let that subscription lapse after I went down the crypto rabbit hole about six years ago, but the philosophy sticks with me. I treat crypto more as longer-term play, and find that I do better the less I try to worry about TA and swing trading, and just buy tokens and sit on them. I could brag about picking Ethereum at thirty cents, or getting in on ChainLink right after the ICO, but I’ve held numerous bags to zero over the years, and lost thousands on scams that I thought we’re going to have a big payday. And my biggest returns have been from good old-fashioned dollar cost averaging Bitcoin, every week, every month, for the last three years.

So let’s get to it. I have a couple pieces of interesting advice, and many, many warnings.

Crypto exposure outside of crypto

If you’re like me, you already have a brokerage account opened up, maybe within a tax-advantaged IRA or self-directed 401K. If so, you’ll want to read my post about checkbook LLCs, but in the meantime, there are plenty of ways to gain exposure to Bitcoin, Ethereum, or the broader crypto space inside your traditional account. The standard way to do this is through Grayscale’s Bitcoin and Ethereum trusts, which trade on the OTC markets under $GBTC and $ETHE. There are other Grayscale funds available, but as a novice, I would stay away from these until you understand the inflows to these funds and the premiums associated with them.

Alternatively, there are many companies holding Bitcoin on their balance sheet. BitcoinTreasuries.com has the most comprehensive list, let me just say that my favorites are miners like $MARA and $RIOT, which have been outperforming BTC. Voyager Digital is my personal 2020 favorite, which is an exchange play that has returned over two thousand percent in the last year.

Every crypto transaction is a taxable event

Let me repeat myself: EVERY CRYPTO TRANSACTION IS A TAXABLE EVENT. With the exception of buying spot with fiat, and some instances of wrapping Ethereum (which I won’t explain here), every sale, swap, airdrop, deposit, claim or stake will need to be tracked for cost basis and capital gains. I am also not referring to straight up withdrawals, transfers or deposits between your exchange accounts or wallets that you control.

Crypto tax guidance from the IRS is abysmal, and will hopefully get cleaned up this year, but till then it is an absolute nightmare. Most of the exchanges will prepare your tax documents for you, but once you start getting involved in DeFi, you will want something to help you prepare you tax documents. CoinTracking (reflink) is one I’ve used for years with moderate success, but the new one that I would probably recommend is called TokenTax. They both can track your Ethereum address directly, and import data from most exchanges via an API. There are alternatives, so experiment with a few and find one that works for you. You do not want to skimp on this. They should offer you a choice on how you want to calculate your gains, FIFO, FILO, or whatever, I prefer HIFO, for highest in, first out.

So no, there’s no “like for like” exception for crypto like there is in real estate. If you buy ETH with BTC that you bought on Coinbase, you have to calculate gains on the BTC and record the cost basis of the ETH in fiat terms. Same thing goes if you — god forbid — use your crypto for something useful, like actually buying something. That’s right, you’ll have to track cap gains on that proverbial cup of coffee that you bought with your bitcoin. This may change under the Biden admin with more crypto-friendly officials, but for now that’s the way it is.

The only way to legally avoid all of this is through a tax-advantaged account like an IRA or 401K. Beware though, these “crypto” retirement accounts may be custodial accounts that restrict what you can buy, don’t let you withdrawal your coins, and charge high trading fees or insurance. Again, you can read my post about checkbook LLCs to see how I’m keeping tax-advantage status and controlling my own funds.

Crypto never sleeps

For the most part, equities traders are used to standard NYSE hours, 9:30AM-4:00PM, Monday through Friday, save holidays. Not in crypto. Markets are always open, although the mood can change as traders wake and sleep from the East coast to the West, Asia to Europe. Many times I’ve caught myself getting ready for bed, only to see Bitcoin make some big move that I want to be a part of. It’s easy to lose sleep. Crypto is also immensely addictive, and if you’re like me you may need to take steps, like deleting apps off your phone, if you find yourself checking the price of Bitcoin every five minutes. If you drink or smoke, you might also want to set limits and rules so you don’t FOMO into a stupid position while you’re bent and wake up rekt the following morning.

Exchanges are not your friends

It’s easier than ever to purchase crypto these days, but one of the biggest mantras in the industry is “not your keys, not your coins”. This means you don’t use exchanges as your banks. If you’re dealing with any substantial amount of funds, you HAVE to get a hardware wallet. Trezor and Ledger are the two most common ones, but you should do your research. If you’re dealing with Ethereum you’ll probably wind up dealing with Metamask, but you’ll want to hook this to your hardware wallet as well. Same goes for any other software wallets such as MyEtherWallet, Exodus. Newer tokens might not have support for anything other than an executable that runs on your computer, or just a website that you interact with. Do your research, and never get in a position you can’t afford to lose.

Exchanges get hacked, and most don’t carry any type of insurance, so never keep more on them than you need for a trade. You can use leverage on some exchange as a way to negate this risk (not to trade more than you have!), but for the most part, you’ll want to keep things on your wallet where possible. The rise of DeFi lending and interest bearing accounts which provide yield on deposits are making it very attractive to do the opposite, but beware counterparty risk, and spread your funds if you feel compelled otherwise.

If your Exchange doesn’t allow you to custody or withdraw your funds, i.e. Robinhood or Paypal, then you’re not really buying crypto, you’re buying an IOU. Stay away from them. The major fiat onramps in the space if you’re in the US are be Gemini, Kraken, Voyager (reflink), BinanceUS, and I hate to say it, Coinbase. If you’re using Coinbase, or Gemini, make sure you swap to the “pro” versions with proper limit orders, not the market order only interfaces that they put up for noobs with the three percent fees. These aren’t available on the mobile apps, so use the desktop/web versions to access them.

Speaking of limit orders, no crypto exchanges that I’m aware of have implemented trailing orders, which is a shame. I have my own cynical theories as to why. A few, like Binance and Kraken, have access to leverage and OCO type orders, but for the most part you’ll be dealing only with limit and market orders.

And even after all all these years, the major exchanges haven’t figure out how to stay up during moments of high volatility and activity. In fact, one of the sure signs of a bull run is Coinbase going down.

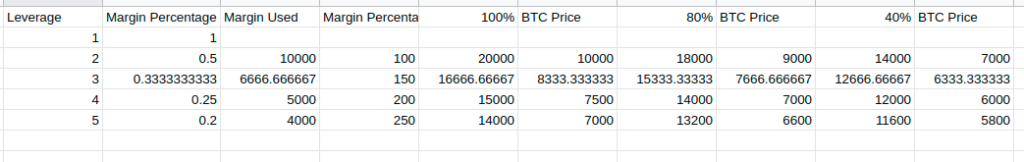

Beware limit orders and leverage

Just stay away from leverage unless you know what you’re doing. Period. It can be tempting when BTC is posting a huge green candle and you want to go in 5x with everything you got, but you’re playing with whales, and they love to stop hunt. They routinely pump or dump the price to trigger cascading liquidations, so they can buy back up or dump on the market after the carnage has cleared. Sometimes it might even be the exchanges, countertrading against you. Beware.

On the other hand, don’t count on that stop-loss hitting. Exchanges have gone down, during these flash dumps, preventing those orders from closing, and leaving people holding a bag after the carnage has cleared.

And never short Bitcoin in a bull market. Just don’t do it.

Don’t listen to anyone

The trollbox on TradingView can be the absolute worst, most toxic place in the world sometimes, everyone’s an expert and knows exactly what the market is going to do in the next five minutes, believe me. They’ll shill their bags, pump them, and talk them up and up and up. It’s easy to get caught up in it. Same thing goes for Twitter, as well, and I say that as someone who spends an inordinate amount of time on Twitter. Just assume that anyone who is talking up a $cashtag or posting a chart is shilling their bags.

Sure, you can ape along with them, and maybe you’ll do alright, but if you read up on projects after you’ve aped into them, you’ll eventually be able to sort the cream from the crap.

And never, never buy the FOMO on a huge green candle on the five-minute chart, unless you’re prepared to exit your position at a moments notice. Like I said, I don’t trade like that, anymore. I prefer to open a small position, do some research, and scale in over time if I think the project has promise.

Hopefully this advice will be helpful to you. I know much of it seems doom and gloom, but I want you to be warned. In 2017, I saw life-changing riches come in the blink of an eye, and in 2018, I watched it drain away cause I failed to take profits. This year, we’ve seen just the beginnings of the bull market return, and I’ve already seen more than 4x returns in my cryptoequities account in the past six months. And I truly believe we haven’t even seen a tenth of what we should expect before the end of the year.

If this piece is helpful, please drop me a line with some feedback, or your question, as I know I have more to share. As they say, an expert is just one who’s made enough mistakes in a given field, and I can help you avoid the same mistakes, then my day’s work is done.

![What is a Decision Tree and How to Make One [Templates + Examples] - Venngage](https://venngage-wordpress.s3.amazonaws.com/uploads/2019/08/ad-mistake.jpg)