So I’ve been somewhat occupied with a new lending protocol for the last day or so. It’s called Impermax, and it allows one to use Uniswap liquidity tokens as collateral for a leveraged position. You can also supply one or two of the borrowed assets in each pool for a nice APY, with no risk of impermanent loss. I’m just testing it out after getting an airdrop, and it advertises as the first DeFi protocol that allows you to use LP tokens as collateral.

I read the whitepaper last night, it was written last year, and has a lot of math detailing the liquidation system. The system seems pretty well put together. There’s a core system, that holds all of the user state, and upgradable proxy contracts for the rest of the implementation. This design also allows for third parties to interact with the core system as well, meaning that it could be put to use in third-party protocols at some point.

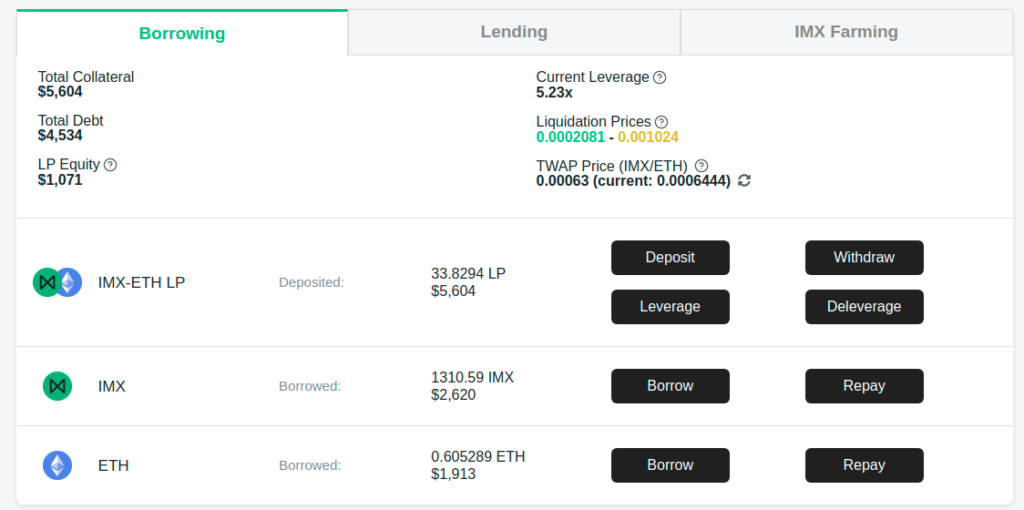

Each Uniswap LP token gets its own pool, so a liquidation in one pool does not affect the others. For each pool there are three smart contracts, the LP collateral contract, and one each for the components of that LP, borrow A and borrow B. Lenders can provide either of borrow A and B, or both, and borrowers deposit LP tokens, and leverage their position by borrowing both tokens and staking on Uniswap. Here’s what it looks like after I took my IMX airdrop and opened a 5x long last night.

You’ll noticed the liquidation prices, there are two, representing an upper and lower band. The reason for this is that if the ratio of token A to token B gets out of whack, then impermanent loss can make it difficult to repay the loan. Here’s a chart of the band a couple hours after I opened my position last night.

Now there still seems to be some problems with the system, especially with regard to the liquidations. I got liquidated on the above position, which clearly shouldn’t have happened. I was only playing with a small stack and lost a small portion of my LP collateral, so it wasn’t too bad. Generally speaking, you want a leverage position that you won’t have to actively manage. The USDT/USDC pool seems like an obvious play here.

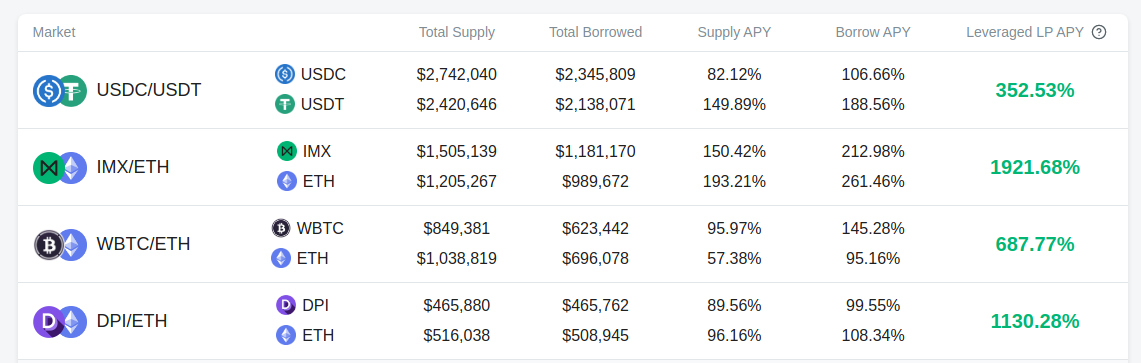

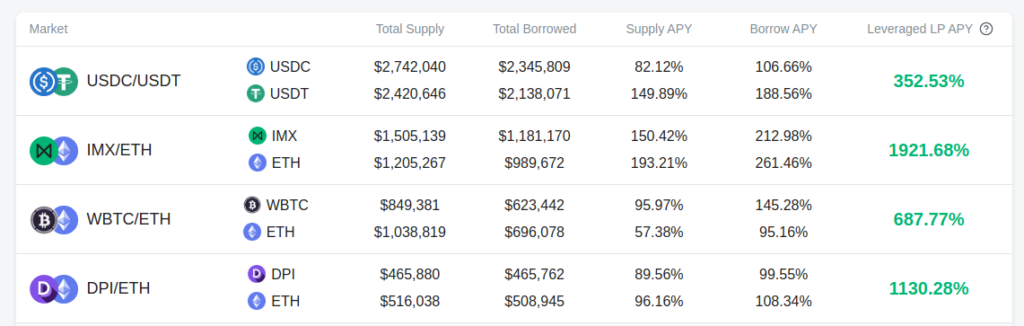

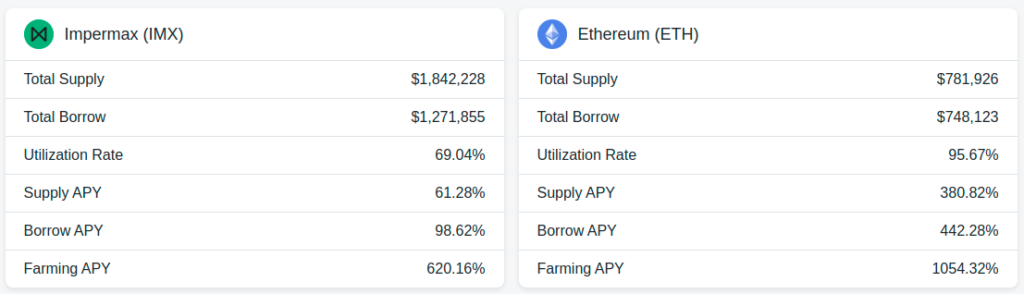

Borrowing is expensive, and is supposed to be offset by farming emissions via the IMX token, but there appear to be some issues with whether this is actually working properly right now. Supplying assets seems very lucrative, and it’s taking every bit of self control I have right now to keep from staking every single stablecoin, ETH and wBTC token that I have into the pools right now. And since the asset in each pair is in a separate contract, you can provide both assets and earn yield without worrying about IL.

On the topic of security, the protocol has several audits available, but with TVL only at $20 million right now, I’m not sure that IMX has been battle tested enough to warrant anything more than a small position, but I’m definitely looking at allocating some C tranche funds from the BCM reFIREment fund. In all, I’m very excited about Impermax’s potential. It’s got some kinks and improvements that need to be made, but it’s appears to be very lucrative for anyone willing to ape into it. Managing a leveraged position can be costly, but yield farming seems like a no-brainer.