Launch notes and other updates

I procrastinated writing this morning’s post as I didn’t know what I was going to do today, and it seems like it was a good idea because today was Uniswap V3 launch day. And it was a bit of a mess. The main problem came down to the same EIP-712 signature issue with Metamask and hardware wallets. You just couldn’t use the V2->V3 migrator, as it relied on a signature to approve the conversion. Opps. The entire Uniswap Discord was full of people with LP tokens on their hardware wallets that they couldn’t migrate! Myself included. I wound up moving my UNI/ETH LP over to my Metamask softwallet address and migrating it there. It’s not safe, so I’m moving it back to my hardware wallet right after I finish posting this.

I had some other tokens on my Lattice1, and ran into the same problem, even though they had just pushed out EIP-712 support a few days ago. There was a slight problem with the Metamask plugin that the team was able to patch, and I was able to confirm it right away. This means that the Lattice is currently the only hardware wallet on the market that supports this important signature scheme.

I’m a bit miffed by Uniswap’s lack of communication on this lack of hardware wallet support in their migration process. They must have known about it, but just decided not to mention it on their docs? Granted, it is the fault of Metamask and the hardware wallet providers that this hasn’t been fixed in the last several months, but Uniswap could have at least given people a heads up.

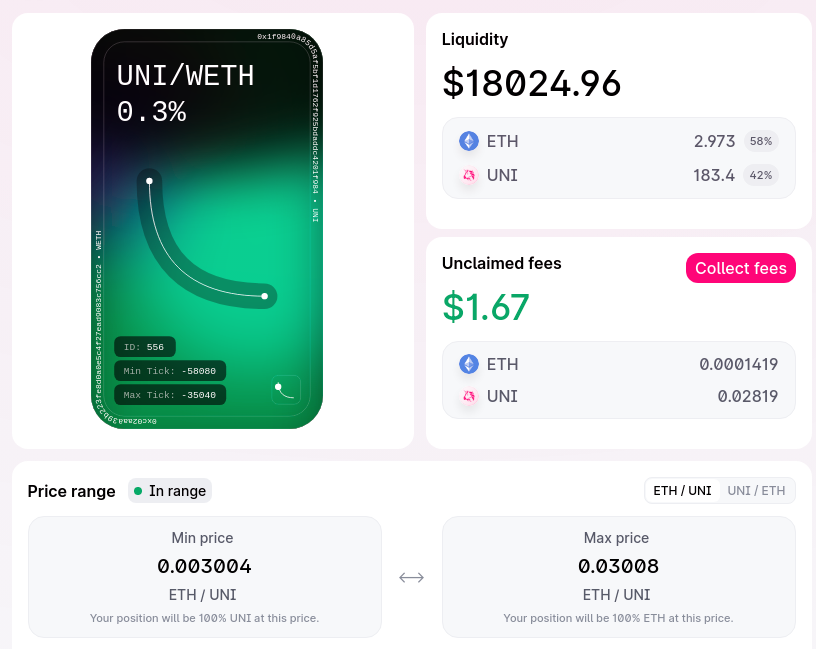

The migration is expensive, it cost me $150-160 for the two I did, and you have to know what you’re doing. You can’t just use the old zero-to-infinity LP provisioning that underlied Uni-V2, you actually have to look at a chart and figure out what sort of range you want to do. With my UNI/ETH LP, I opted for this range, which I figure should good for a while.

As long as the price stays in this range, I’ll be providing LP, if it moves out, I’ll have either 100% ETH or 100% UNI. This is a lot different from the impermanent loss that we’ve become used to. If the price drops to the bottom of my range, my position is all UNI. If it goes higher, it’s all ETH. This is a much different risk model that what we’re used to.

The other big thing here is the collect fees button. Before, fees were rolled up into the protocol directly into the LP, but now it’s a separate button that can be claimed separately. I’m not quite sure what the design decision was behind this, but it seems curious. I suppose one could just wait until they remove liquidity, hopefully the fees will roll out with it, but I can’t see myself using that feature too often. Not until when Optimism launches and it won’t cost me $40 to claim it.

This is an interesting system, and it’s going to be interesting to see how things play out in the coming weeks. Liquidity mining is going to be very interesting to watch, to see how teams who have been relying on V2 LP tokens deal with these new NTFs. It’s going to require a completely different paradigm for project launches. Staking contracts will have to be re-written completely. So far, it doesn’t look like anyone has tried to provide V3 liquidity for Klondike’s kBTC/wBTC pairs, but I wonder if it would be possible to provide concentrated liquidity on V3 that would essentially absorb all of the fees on V2. Perhaps. There does seem to be some arbitrage opportunities between the V2 and V3 pools now, but I’m not likely to have time to mess around much with that for now.

Other updates: The SAIA Dao continues to grow, we’re getting a constant stream of contributors, and it’s become a lot of work to keep pushing these proposals through. I’m trying to get people to help me a bit, as it’s taking a lot of time to flush these proposals through every day. I’ll probably just shift down the amount of time I check them, and just stick to sponsoring and enacting them.

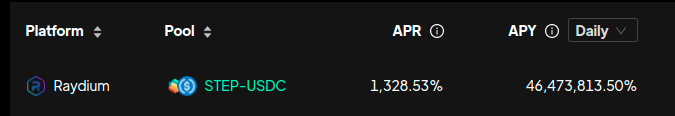

I aped into the Step.Finance token on Raydium today, right before it dumped — of course. The APY is ridiculously high and I haven’t lost 2% yet so I’m going to hold and compound these rewards daily. It is quite ridiculous right now, even if it is only supposed to continue for a few weeks. Step basically wants to be the Zapper of Solana, and it could be very lucrative.

My Impermax IMX/ETH leverage is still sitting pretty. 1.8x or so, even though I need to check it right after this. I’m wondering what Uni V3 is going to do to the V2 fees. It may destroy their entire operating model. We’ll know more after we have some volume data. This may be a very dangerous position to hold right now, but I’m playing with airdrop money so I’m not really concerned. Might wind it down if gas costs come down. We’ll see.

Bankless has a DAO! I’m really looking forward to this, and am considering a small stake.

The World Computer launches on Friday. After several years, of development, Dfinity is going live. I have not been paying enough attention to this one over the years. I took a look over some docs earlier, but I don’t want to distract myself from the work I’m doing in Rust right now, but I’m going to listen to the launch event and maybe buy some tokens. They’re apparently only going to be on Coinbase Pro, which may limit my options. We’ll see.