TL;DR: Fund an AltoIRA Checkbook+ LLC, and buy, trade, or sell bitcoin and other cryptoassets within a tax advantaged retirement account. Reduce your taxable income AND eliminate capital gains taxes!

I am so excited I’m almost giddy.

Background: I’ve been investing in equities since the early 2000’s and had employer 401Ks that I rolled over into a IRA brokerage account in 2017, a few years after I started getting involved in crypto. In 2019 I started buying Grayscale Bitcoin Trust ($GBTC) as a way to gain exposure to bitcoin. It currently makes up the majority of my total portfolio, about forty percent, and another forty percent are in crypto mining and exchange positions, and Grayscale’s Ethereum Trust. I’ve been looking for a way to reduce exposure to Grayscale’s products which trade at a premium, and put funds in BTC directly, while retaining my tax advantaged status. One of the benefits of trading within these accounts is that I can enter and exit a position without having to pay taxes on any gains.

Alto came to my attention while reading a post about the DeFi Pulse index. Alto was just kinda dropped in there as a side note, and after after a bit of back and forth with the CEO, and I went ahead and scheduled a call with one of his associates, James O’Brien.

I was a bit deflated going into the call, because the fees that I were told given were a bit off-putting, one percent a year as a maintenance fee, plus one point five percent per trade. That might be ok for someone starting out, but there’s no way I would go for that. James explained that the crypto product that Alto offers is basically a vehicle for Coinbase custody, which is geared at institutional investors. The fees are what Coinbase charges, and covers insurance on the funds. Of course, you’re limited to what tokens Coinbase offers, and you can’t move anything off to a private wallet. Fair enough, but it’s not for me.

So what really got me excited was when O’Brien told me about the checkbook LLC which is a self-directed IRA plan. You have checkbook control over your funds.

“Checkbook Control” is the term used when a self-directed IRA owner has complete signing authority over an account that gives access to his/her retirement funds. This strategy is achieved through the establishment of a Self-Directed IRA LLC. Since the LLC established is a business entity, it can establish a checking account. The LLC is funded by using retirement assets like an IRA which then funds the LLC’s checking account. This offers greater investment freedom, allowing you the IRA holder to meet your investing goals and manage your assets with ease.

What is Checkbook Control?

These type of entities can be used to purchase practically any asset, including real estate or cryptocurrencies. And the cost that Alto charges to do the necessary paperwork is only $750 dollars, that’s five hundred to setup the LLC and necessary documents, plus two fifty a year for what I assume are the required tax documents and so forth. That’s much better. I can use whatever exchange I want, park the tokens in a cold wallet, liquidity pool or lending provider, and sell them without a care in the world. My keys, my coins.

The only real downside is that crypto assets cannot be transferred directly into the IRA. Only cash goes in. So if one has existing crypto holding that one wants to make into a tax-deductible contribution, you’ll have to liquidate to fiat, transfer the funds into the IRA’s cash account, then to your crypto on-ramp to purchase the asset again. This could lead to some slippage if one doesn’t have cash on hand, but that can probably be optimized through some dollar cost averaging process.

There’s another downside to a crypto IRA, and that’s the fact that IRA contribution limits are currently capped at $6000 a year. There are similar vehicles in the 401K space that have much higher limits. I found one company, called Solo401K, that provides this service. I chatted with one of the associates over the web. These plans are available to self-employed individuals, contract employees, but not individuals who are employed by others. The limits are closer to thirty thousand a year, and there’s other advantages, like being able to take a personal loan out against the account. Since I’m not a contract employee or self-employed, the 401K plan isn’t an option for me. Solo401K is by Naber Group, which also has an IRA option, but their setup fee is twice as much as Alto, and they charge an extra hundred a year in fees.

I went ahead and setup my Alto account this morning, the process took about five minutes. The main thing you need to think about is what type of IRA you want to open, whether traditional, Roth, or, if you’re a business owner, a SEP IRA. Other than that, there’s several forms to fill out, and it appears that it will take up to two weeks for the paperwork to come back on the LLC, which is created in Arizona.

Once this is all done, and I’ve opened new bank and exchange accounts, I will begin liquidating my IRA positions in GBTC, rolling over the cash, and buying spot BTC. I’ll probably do the same with my ETHE holdings as well. I’ll also need to liquidate enough of my existing crypto holdings to max my 2020 annual contribution before April 15th, unless I can come up with that kind of cash in the meantime. It might be a wash with capital gains on any crypto sales, but I’ll figure that out.

I’ll also be converting my employment to contractor status. I’ve already had a talk with the bossman, and I should be able to make that happen before the end of the year, and switch my IRA to a SEP or 401k to take advantage of the higher contribution limits. (Alto plans on releasing their 401k product sometime later this year.

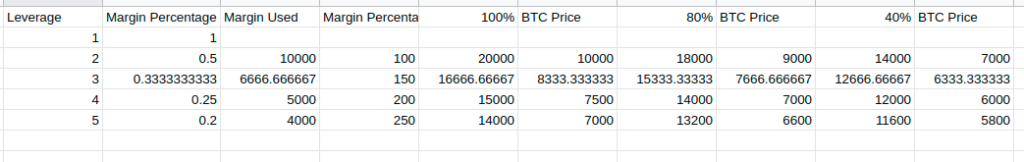

Lastly, a warning. There are rules about how you handle funds in these checkbook accounts that you have to be aware of, like no commingling of funds, no double dealing, and nothing that enriches yourself or other family members, like buying real estate or businesses that you or they have a stake in. The IRS also prohibits purchases of collectibles, which may be a problem with NFTs, but other than that, you have complete freedom to buy any token, using lending platforms and leverage, or ape into whatever yield farm you want. As long as all the gains stay within the confines of the LLC, you are golden.

If you’re interested in opening a Checkbook+ IRA, use my referral link to get $75 off the first year’s fees.