We’re already a week into February; it seems like this year is flying along already. And what a crazy one it is. I’ve been spending a lot of time watching the price of Bitcoin; it seems like the bull market is here and ready to fulfil my dreams of wealth. Also, it seems like Sanders is in position to take the Democratic presidential nomination. On the other hand, Trump just got acquitted by the Senate, and the Democratic party seems to be doing everything they can to fuck things up.

I’ve been very low-key about crypto lately. I don’t talk to people much about in real life. I have fun with it on Twitter, but the fact is that if things go right, I don’t want people to know how much I’m involved with it. Keeping control of your bank is all fun and games until someone gets kidnapped. Someone on Twitter was bragging about being a member of the 10BTC club, and I warned them about OPSEC. They took the tweet down after.

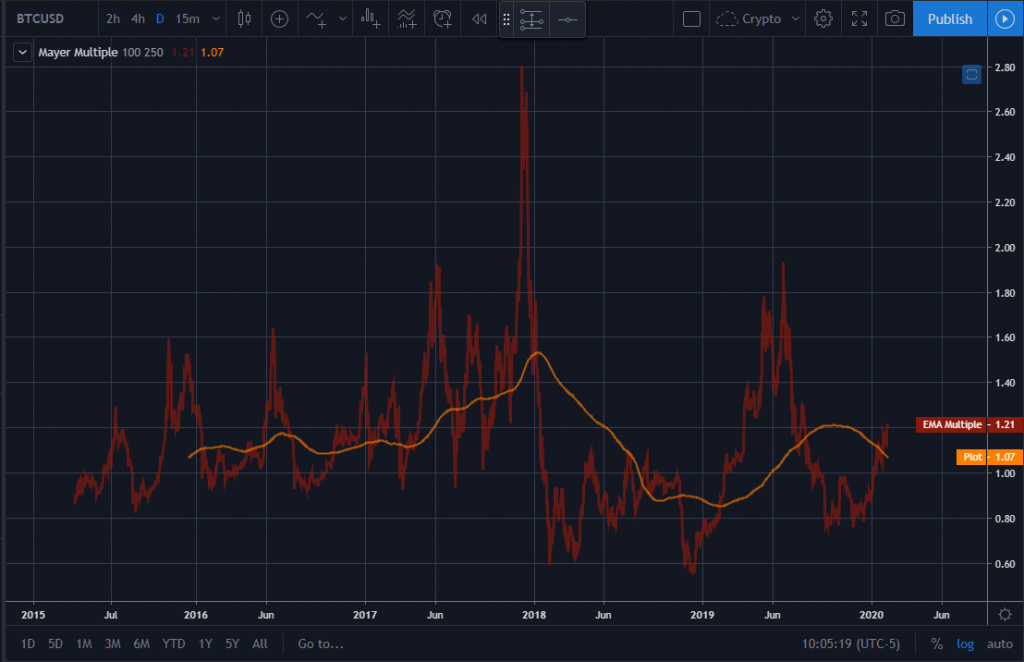

I’ve done my best to protect my holdings. I’ve got redundant hardware wallets plus the private keys protected, but it’s starting to get to the point where I don’t feel entirely safe. I could literally make more from hodling this year than I do at my day job. That’s insane. Many months ago, during the depths of the bear market, I set some dynamic price targets to sell some of my holdings once things took back off using the Mayer Multiple (MM), or the price of BTC as a multiple of its 200-day exponential moving average. I’ve also posted the current MM chart and the TradingView PineScript I used to create it as well.

//@version=1

study("Mayer Multiple", overlay=false)

psma_length = input(100, title="Price SMA Length")

msma_length = input(250, title="Multiple SMA Length")

ma = sma(close, psma_length)

multiple = close / ma

mma = sma(multiple, msma_length)

plot(multiple, title='EMA Multiple', color=#891A0D, linewidth=3)

plot(mma, color=orange, linewidth=2)Looking at the above chart, one can see that the price of bitcoin has usually peaked when the MM hits 1.9. The winter 2017 bull run peaked just under 2.9x. So a possible strategy would be to start selling as the MM approaches these numbers. I won’t be dumping my holdings at these points, rather I’ll probably start scaling out gradually. I’ve been using a dollar-cost averaging approach, or accumulating, every week, so I think I may start selling the same amount as the price reaches 1.55-1.60x, which is currently $12,900. However, I have made a decision to sell a significant portion of my holdings if we reach 2.88 like we did at the end of the last bull run. That would be just under $24,000. Of course those numbers are dynamic and will likely be much bigger if we take our time to get there. Otherwise, I assume we’ll have some sort of blow off top with opportunity to buy back in later.

I truly believe that Bitcoin represents the greatest financial opportunity that I’ve seen in my lifetime, and one of the main difficulties I’m struggling with is how to balance my risk. I’ve already got a majority of my net worth in crypto, and the temptation to go even further is strong. I’ve written about GBTC in the past; in the next week I’ll complete a 20-week value-averaging plan that I’ve been executing. It’s just hit it’s max payout target for the first time, and we are fully in the black. More about that next week.

That said, it’s hard finding a sell strategy. The important thing is to have a plan, and having the discipline to execute it. My hope is that I can use some of the longer-term trend indicators to build a cash reserve that I can redeploy during the next bear market. If we’re setting up for another multi-year parabolic bull run, then I want to make sure that I take profits and do so slowly enough that I don’t miss too much of the top.