Spent some time today delving into Uniswap. Here’s a couple of posts that have some good information:

An Introduction to Automated Market Makers

I had a bit of a flash this morning that I should probably start exiting my IDEX position into ETH, specifically the yETH pool, but it turns out that Yearn has halted deposits on the pool. I’m glad i got my little test deposits in when I did.

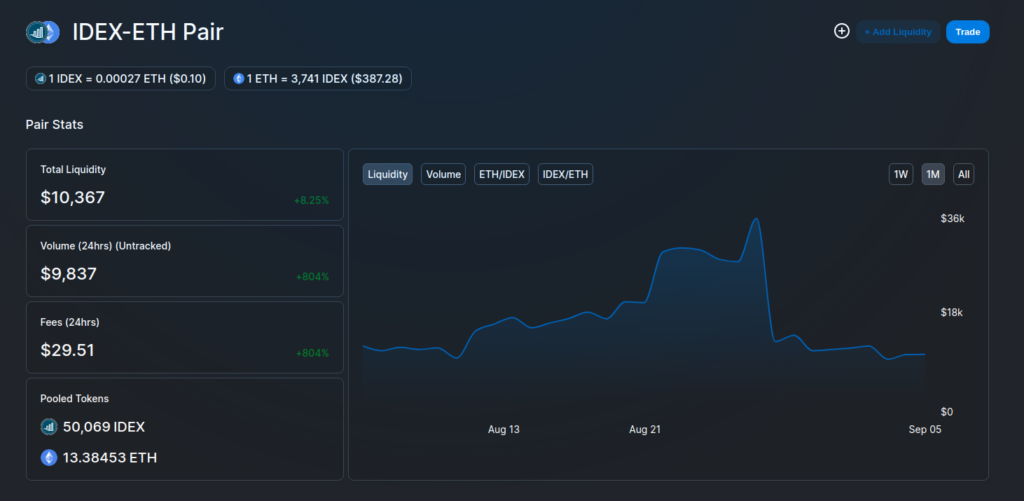

Still, I was looking at the best way to exchange my tokens. On IDEX, obviously, but I have never actually used them since they implemented accounts, so I can’t trade there as of now. Binance has trade pairs to BTC, but that would involve another trade. Then of course, there’s Uniswap, so I took a look and found an IDEX-ETH trading pool.

The liquidity here is not very impressive. And I saw an opportunity for me to provide some, although I still don’t understand how the assets in the pool are being staked together. I would assume that the pool would need to be 1:1 in value between the pairs, but it actually looks to be about 1:2, as far as the USD value of IDEX-ETH. And I’m not going to put any more capital at risk until I understand what this “divergence loss” is and how I can keep from being affected by it.

I also spent some time looking for arbitrage opportunities. There was a bit of a price divergence between the IDEX exchange price and the Uniswap price, but the liquidity is so low that trying to take a large order would eat the price divergence back to par, and dealing with low amounts would have caused any profits to have been eaten up by gas fees.

So for now, I’ll take no action while I wait for a bit of a price recovery on IDEX and explore other opportunities. I’ve given up trying to get the Monero blockchain running locally, and have it syncing in a cloud server. What was taking over a week with my SATA stripe array looks like it’ll take a few hours on cloud.

Other than that, I’ll be working through Mastering Ethereum, trying to understand these smart contracts, and hopefully figure out how these smart contracts work, how to design my own, and how to build programs to interact with them.