I spoke to a wealth management expert yesterday. It was an interesting conversation, to say the least. They had reached out to me via LinkedIn because we share the same alma mater, and I figured it was good timing, given my current interest in wealth management, and generational businesses.

They were actually fairly familiar with crypto, they had a background in information systems. He had heard of DeFi, but I think I lost him explaining that and when the subject turned to the work we were doing with MUG token. He wasn’t judgy at all, either.

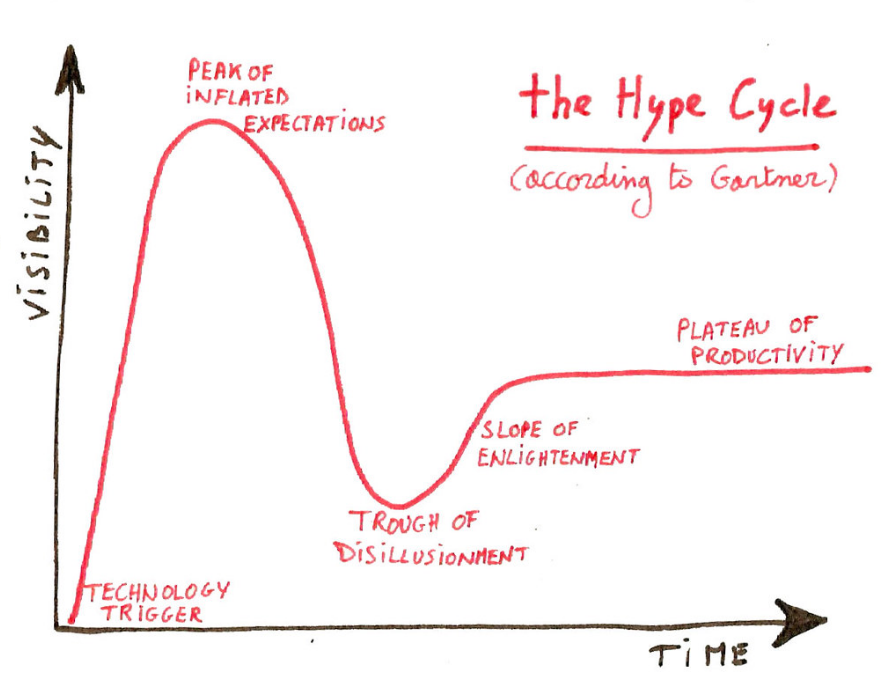

We spoke for about an hour, I asked him to describe his professional career, and then I launched into my story of running a business (into the ground) in my mid-twenties, and getting started in investing shortly there after. I got into spec mining in 2014, bought ETH when it was pennies, then cashed out my brokerage account for crypto during the 2017 run, and watched my modest four-figure stack turn into six figures over that winter. The sudden success caught me by surprise, and, lacking an exit strategy, I held all the way down through the 2018 correction till my holdings were only 80% of what they had peaked by the start of 2019.

I spent the next two years continuing to invest in bitcoin, and doing spec mining and basically learning everything I could about the industry, and positioning my investments within my IRA among crypto-related equities like $GBTC, $MARA and $RIOT. Q420 was a blast.

As the bitcoin bull-market resumed in the latter half of 2020, crypto-related equities actually outperformed BTC by an order of magnitude. So while my crypto portfolio gained 10x, my IRA actually outperformed BTC, despite GBTC and the others only representing a modest portion of my original cost basis.

I talked about the FIRE movement, and how we came up with out magic number using the four percent rule. That, my new friend understand. I told him basically how we had set our FIRE by 2024 plan last year, (halving to halving), and how we were already hit our goal in one year. Well, almost.

We’re close, but not close enough for me to just call it quits and cash out. The difference between this cycle and the last is that we have plenty of lending platform that can provide a significant yield income on crypto and stablecoin deposits. Obviously there’s no telling how long it will last, but if things keep up we may have to rewrite the four percent rule to the twenty percent rule.

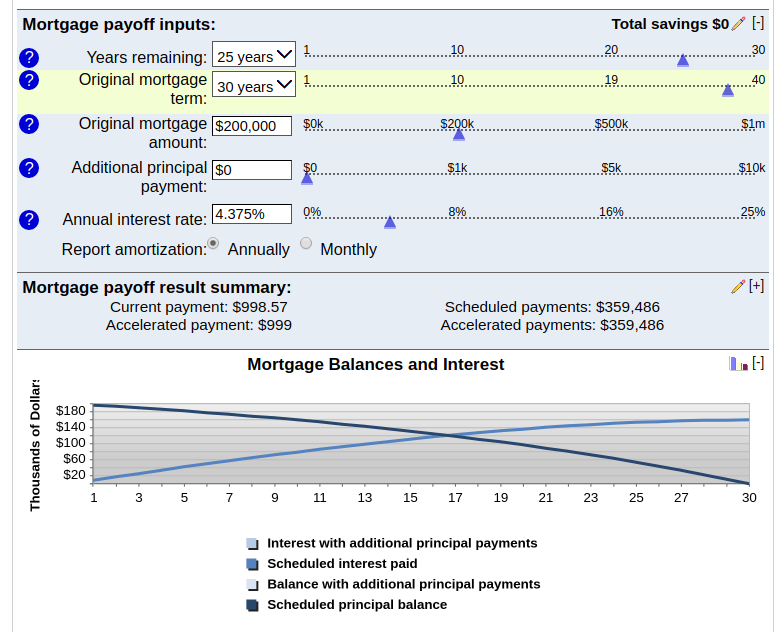

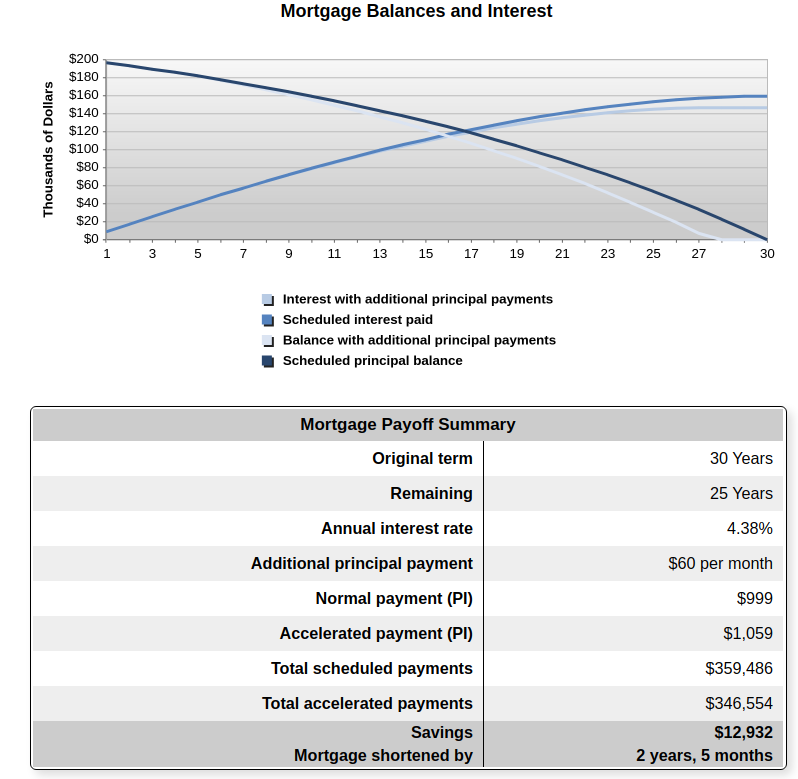

My wife has put some qualifications on my upcoming so-called retirement: no debt. So I’ve got to pay off our mortgage if I want to avoid separation. The question is, how to go about that? I’ve already decided that I’ll need a significant cash cushion, equal to a years salary, and I’ve started taking claimed profits from my highest generating project and selling that to stable coins. That’s not gonna get me all the way there, so I’m looking to liquidate some of my smaller, more speculative assets that have done well to cash as well. That may get me closer, but my plan is really dependent on a run to six-figure BTC — and beyond. Somewhere between $100-120k should do the trick.

I told my new acquantaince that if I can double my IRA, I’d have enough money to pay the income tax, early withdrawal penalty, pay off the mortgage, and still have enough left over to provide interest income to satisfy our new, lower magic number. More than half of our monthly expenses are our mortgage, so paying this off would lower our capital requirements significantly.

They pointed out a couple points that I had misunderstood. First off, I was under the impression that any pre-retirement distribution from an IRA would cause the entire IRA to be considered as income. He corrected me, that only the distribution itself would be, the rest of the IRA would be still be protected. He also pointed out that selling my long-term BTC holdings would only be taxed at fifteen percent, instead of the forty percent that an early IRA withdrawal would cost.

I’ve been running the numbers back and forth all day, trying to figure out what’s the right thing to do. I am more emotionally attached to the bitcoin I own, I’ve got a hodler’s mentality and have been telling myself that I’ll never sell them — although that’s not quite true. Right now my moving target, (3.6*200-day moving average) is around $87k and rising, so it may be a while before we get there.

Thankfully, I don’t have to make any decisions right now. I’ll just keep taking profits on the smaller positions and yield generating protocols every week or so, and revisit where we’re at in a month.

And here we are now, with BTC edging $80k and toying with new ATH. Things are looking very nice indeed.