We had a bit of a dip in temperature last night, which hopefully will be the last frost of the year. My wife and neighbor were talking about their garden plans last night over Thai food, and I’m almost done planting the seeds of what should be a very lucrative yield farm come this next DeFi summer.

Okay, I promise no more contrived metaphors, at least for the rest of this post.

The market seems ready to explode. BTC has been edging $60k, ETH at $2000 as I write. Funds are moving off exchanges left and right, miners aren’t selling, and there’s all kinds of spoofy sell wall action going on. I am a lightning bottle of excitement. I’m considering moving some funds to Index Coop’s FLI token, which is a ETH 2x leverage token. BTC dominance is falling though, so it seems like alt season is in full bloom. There are tons of projects launching that I’ve got to vet in the coming days, and I also discovered that I qualified for a couple airdrops that I didn’t know I had, UMA and Popsicle.Finance ($ICE) on BSC.

I finally bought in on the FEI Genesis event. I went 100% to the TRIBE governance tokens. I figure the chance of making a huge return on the FEI mint is going to be low. It looks like the first mint is going to be well on the high side of the bond curve, people might wind up paying $1.01 for FEI. TRIBE is either going to dump, or it’s all going to get locked up and people are going to buy more and it’ll moon. If it dumps I’ll just go long with governance, if it moons I might take my initial capital out. One thing I did confirm is that the FEI burn/mint incentives don’t apply to the FEI/TRIBE pair, so that may be a loophole that we need to look at. Unless there’s an incentive for the LP, which there isn’t from what I’ve read, then I’ll be staying out of that, and looking for opportunities to mint FEI if it falls on the bonding curve. You’ve got another day or two to get in on the action, all Genesis participants will get a pro rata reward of 10% of TRIBE tokens.

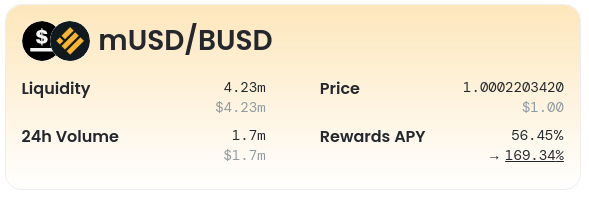

I deployed funds for the B tranche into mSTABLE yesterday. I’ve been following the project for some time, but a few days ago they launched their own pools for mUSD/BUSD and mUSD/GUSD. The BUSD pool was over 100% APY yesterday, but seems to have dropped significantly overnight, however there’s a 3x bonus if you’ve staked enough of their MTA token. You lock it up for vMTA, similarly to CRV/veCRV, to get voting rights on the DAO and earn the higher APY. I did the math on the vMTA needed to get the boost, so I locked it up for nine weeks and deployed funds.

So with regard to the emergency fund, (I’m still not sure whether to call it that or reFIREment funds,) we are almost fully deployed. I’ve got one more allotment for the A tranche to deploy, plus some spare funds that I may keep at the ready for anything super-risky that comes out. I think I may put the rest of the A funds in something like BlockFi or Voyager, just so they’ll be liquid. If BlockFi ever gets their debit card out, I can use those funds to buy groceries while earning interest in BTC. It’s not quite enough to live off the interest there, but when I do quit my job I will need some source of liquid funds.

I’m not really sure what else I’ll be working on today. I’m deploying funds in some pretty obscure projects, so my Zapper balance has been dropping off. Checking balances on some of the untracked coins and vaults will take a few minutes to update my spreadsheets for an accurate snapshot. Then I’ll probably do some research on some of these other projects.

I’ve got a few more seeds to sow.