Some thoughts about Alchemix

I’m taking a day off with my wife to have a date. We’re splitting the kids, Elder is going to her grandmother’s, Younger to the neighbors, and heading out to an amusement park for a food festival. It will be much fun, and much needed. Before COVID we had season passes for the park and brought the kids three or four times. I never once got to ride one of the big coasters, Missus never got to see a single performance show, so we’ll be taking turns today. I hope the weather holds up, it’s going to be cloudy all day.

We also booked tickets to Bitcoin2021 in Miami. Airfare was free thanks to some credit card rewards. We didn’t have enough points for the hotel room, but that should be a business expense, as is the tickets themselves. June will be exciting: I “retire” June 1, we spend three nights in Miami, (again no kids!) and then fly back in time for my birthday the following Monday. I am so stoked. Afterparty here we come!

There’s not a lot I want to cover today. I put some money into the Opolis genesis launch, and spent some more time on BSC chasing insane APYs on random projects on Beefy.Finance and elsewhere. It’s all pocket money right now, but there’s some serious TVL locked up in BSC right now. I think it’s probably the catalyst behind the BTC price stagnating around $58k for the last few weeks. I’m only playing with pocket change right now, these are likely test runs before I start increasing my stake. Eight percent daily returns is nothing to shake a stick at, especially as gas fees are practically non-existent. Most of them are likely scams and ponzis, just forks of forks that don’t bring any actual value to the space, still there’s money to be made if you can avoid the dumps and rugs. It’s all about risk management, basically.

I also staked some funds in Alchemix yesterday. This one really excites me. I finally understand it and why it’s important, and I’m really hoping that it does well. And I can understand why the traditional finance types are losing their minds over it. At its core it’s a standard staking contract, generating yield of off the Yearn yDAI vault. Once deposited, you’re allowed to borrow up to 50% of what you’ve staked, a loan against the future yield off the funds that you’ve staked. That’s right, the vault earnings pay back the debt. I put in $2500 DAI, took out $1250 in alUSD, (which I staked), and the current maturation date of the loan is sometime around November 2022.

Now this may seem trivial, but it seems fairly revolutionary to me. It’s iterative in the sense that they’re taking Maker’s CDP and putting the underlying assets to work, but I don’t know if this kind of loan against future earnings exists anywhere in the TradFi space, but I think it opens up a huge possibility for crypto, especially once they open up BTC and ETH vaults. They’ve basically built up another way to prevent people from selling their BTC. I’ve probably made this point several times before, but it bears repeating:

In earlier market cycles traders would try to swing trade their BTC, trying to time the top of the market cycle, hodl and accumulate during the bear market. We’ve known things are different this time around because of centralized lending platforms like BlockFi that allow you to take 9% interest USD loans against your BTC. This never made sense to me, as I’ve got good credit and have debt in the 3-4% range right now. From a capital gains perspective, it might make sense for others, but it’s never been compelling to me. On the contrary, I’ve felt a better solution is to lend USDC for the eight (or forty) percent gain, and use that as income. But I do have a lot of debt that I want to pay off this cycle.

I’ve been vacillating between selling crypto or cashing out my IRA to pay off my mortgage, I’m not going to rehash that as well other than to say that I’d really like BTC at $120,000 for me to justify the former. I’d much rather take the extra tax hit, to be honest. But Alchemix flips this around a bit. Now I don’t expect yields on wrapped BTC to remain anywhere near the rates we’re getting for stablecoins right now, the demand just isn’t there. The Yearn crvHBTC vault is getting over 10%, but wBTC is only half of that right now. I expect that long term, I would expect them even lower.

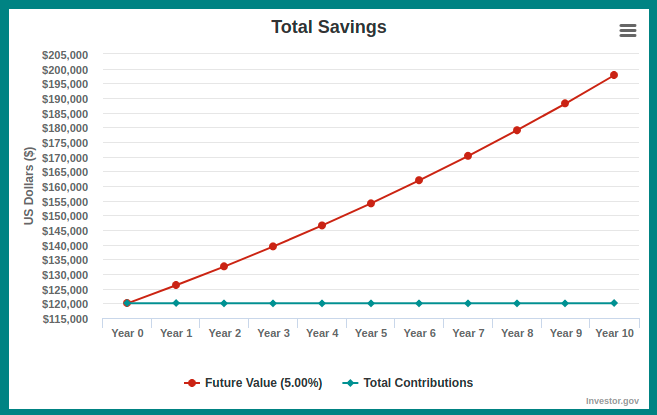

If you look at it as an alternative to my current mortgage or student loans though, the choice seems rather clear, and it’s why I want Alchemix to succeed. Let’s use my student loan debt for example. I’ve got over $60k in debts that come due in September. The ten-year payment plan is something like $600/month. Let’s assume that Alchemix has opened up a wBTC vault that’s getting that five percent. I stake two wBTC, take my $60,000 and pay off the debt. Using the five percent compound interest, the debt should be paid off, or mature, in about eight years, and I get my deposit back.

Now, this isn’t even taking into account the BTC price action. I haven’t heard the details as how Alchemix is going to deal with debt to value, i.e. if they’re going to be subject to forced liquidations like with Maker, but on the flip side, if BTC does continue to have another cycle or two left in it, say to $500k or $1m, then a conservative estimate on debt repayment could be less than half that time.

Now I’m not about to dump hundreds of thousands of dollars of BTC into Alchemix as soon as they open the vault, there’s a lot more due diligence needed to see how, and if things are going to work. Still, it’s making me think, a lot, about the possibilities of both my own debt repayment, and about capital allocation in the future. Again, what Alchemix is doing might already have analogs in the TradFi world, but it’s a novel concept to me. I think much of the pushback I’ve been seeing from the critics has more to do with the yields than the mechanics.

Still, it gives me a option to preserve my Bitcoin wealth and pay off my current debt. It also gives people with significant crypto wealth an option for raising money to buy homes, fund education or other endeavors.