This is either a galaxy brain move or is going to get me rekt:

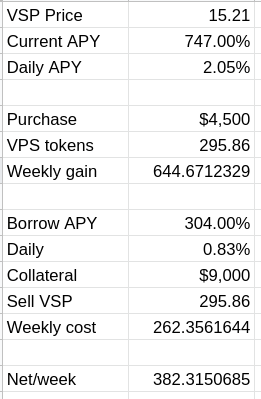

I’m trying to find a way to generate some income for myself. Since it looks like the market could go either way right now, I’ve been looking for a way to generate yield in a market neutral way. Traditionally, one would do this by buying one asset and shorting it at the same time while capturing the spread. Vesper’s vVSP pool has a quite insane APY, so I wanted to see if I could capture enough off of this to cover living expenses, and decided last night to try a position for a week. So I staked my Yearn Iron Bank position as collateral on CREAM and borrowed VSP, which I then staked on Vesper. The borrow APY is quite ridiculous as well, but if my math is right, I should net a couple hundred dollars this week.

It’s not quite enough to live off of, but it should open doors for other similar strategies if it pays off. Since my collateral is in stablecoins, my main risk is that the price of my borrowed asset appreciates and puts my collateralization ratio at risk. Due to the current VSP issuance rate, I don’t believe it’s at risk for some sort of pump. Regardless I think reduce my risk by restaking the VSP back into CREAM, but I’m really not sure about the secondary effects of that. It might put me in a position where I’m stuck and might need additional collateral to rotate out.

My plan is to let this ride for a week, remove some of the staked vVSP, swap some of the VSP to USDC and use the rest to pay back the interest on the debt. Gas costs will be a factor, as will changes to the VSP APY and CREAM lending rates. If it works, I’ll be able to generate cash flow and not be concerned if the price of VSP continues to drop.

When VSP’s emissions rate dies down enough that it’s no longer providing me with enough incentive, I can try other pools. CREAM has a huge number of assets available to borrow, I just need to figure out the best opportunities for them and figure out where to go. UNI is only 3.55% to borrow right now, and I could stake that on Impermax for 57% currently. That’s probably more risk than I’m willing to take on, given that protocol’s only a few weeks old.

I’ll have to look at some other platforms as well to try and figure out other ways I can generate some yield while staying market neutral. Since I’m mostly in stables, ETH and wBTC, I’m sort of in a bind, since returns on ETH/wBTC are pretty lousy across the board, and borrow rates on stables are already pretty high. All told, I’m not sure that this is a viable long-term strategy, but I’ll continue to investigate. I just don’t think I’ve got enough capital to make it work unless I am willing to put a lot of my eggs in one basket. It may be to risky a strategy to pursue.