Well, I did it. Last night I sold off the remaining majority of my BadgerDAO LP, and completed funding of my USDC retirement funds. I actually overfunded it by 14% to be honest, which will actually pay my mortgage for the next five or six months. The funds, which equate to my current annual salary, will be deposited into a variety of yield farming opportunities, and should fund my expenses for the next eighteen months or so. Having this vault of funds set aside will allow me to quit my current day job so that I can focus on crypto full time. If things go well, I won’t need to rely on the USDC funds at all, but will be able to live off of the rest of my crypto holdings through investing, trading, or ideally, launching my own products.

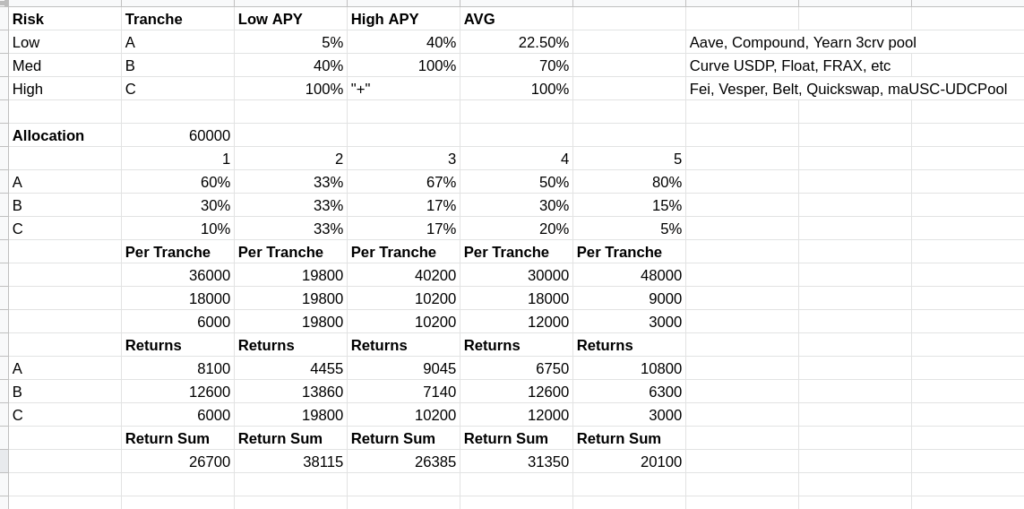

Now that this runway has been fully funded, I need to wrap up my risk assessment of the various staking pools and start deploying funds. I’m almost settled on the safest tranche of funds, the A tranche, and will probably move the first allocation of funds into the Yearn 3crv pool after I finish writing this up. The only question remaining is whether I will allocate all of the tranche funds into one project, or if I want to split it into two. It’s the difference between managing three or six allocations.

Once I have the A tranche deployed I can move my attention to the B and C tranches. I’ll probably require much more time to make these decisions. I’ll probably do some DeFi Safety assessments on some of the newer projects before I fund them. Or, I may reserve the ‘extra’ funds for aping into new launch projects. Decisions, decisions.

As I wrote yesterday, there is a lot of other things going on, and managing these investments is going to be a full time job, at least in the beginning. Staying on top of DeFi and everything going on is a time sink, this really is a amazing industry to be in.

I finally made the decision to sell my Badger LP after looking at the charts last night. I’d been monitoring the USD and BTC pairs, and had some S/R lines I’d drawn on the chart. I told myself that I would wait for it to break both charts to sell, and just got tired of waiting. It’d been falling against BTC pretty steadily for some time, and frankly it was just too much mental energy watching it twice a day. I still retain a modest share of bBadger, as well as staked Digg and Digg LP. I’ll probably hold that and wait for Badger to release CLAWS and their other products. It really is a wonderful community, and I made a lot of money with them, but my goals have shifted.

Last note: Last evening I attended a crypto meetup event. It was outdoors at the house of someone I met on Discord, and there were about seven of us in all, a few friends and several other people I’d met online over the last year. Most of us hadn’t been to an event in well over a year. It was good to chat with others, enjoy some food and talk crypto. I loved it, and had a great time. To think that in a month or two from now I’ll be able to hang out with people without worrying about wearing a mask. I can’t wait.