Wrapping up work, updates on FEI, Coinbase, BasketDAO, Alchemix

I’ve wrapped up what is hopefully my last project at work. I have a few more open trouble tickets that I need to get done, but I should be mostly clear from here on out through June 1. I’m not aware of any open opportunity that my boss has that might give me substantial more work to do in the next 60 days, so I’m getting in the the mindset that I want to be in for my post-work phase.

My wife asks why I would want to quit, when I’m making a comfortable salary and basically working less than three hours a day. That’s just it, comfortable I told her. I really couldn’t explain it. I used to have a joke that I’d repeat often: I love my job, I just hate the work. It’s been backward for a long time, I love work, I just hate my job. My wife would counter that everyone does.

I’m probably picking the worst time to do this. The nightmare scenario right now is that the market tanks, my stablecoin farms have a black swan and next thing I know I’m going to be crawling back to work at the worst time. I’m hope I’m taking the right steps. I’m doing what I think is right, and I think I have a plan that will sustain my family for the future.

I started a writeup on the stablecoin yield tranching yesterday. It’s the first time I’ve done any writing outside of these daily morning blogs since I started writing my personal update, my euphemism for my resignation letter. I put down fifteen hundred words yesterday, and didn’t even get down half of what I wanted to say. Much of it is probably rambling and needs editing, it’s not like I’m Alexander Hamilton, drafting this stuff in my head before I start writing. We’ll pick it up later today and finish the draft. It’s going up as a page, instead of a blog post, which should make it easier to keep up with, since I’ll be updating it over the next couple months to track progress.

I saw a tweet that said the worst thing you could do right now is start a fund. It’s beyond stressful and gets really bad during a bear market. I think they’re probably right. Everyone thinks that they’re a genius during a bull market, and my hubris is my worst fear right now. I see it reflected in my mother’s expression when I told her that I that I was retiring. I have got to have a solid plan.

FEI seems to have imploded. I escaped any significant loss, I put two percent of my available IRA funds toward it, about $1200, knowing that it had a high risk of failure. I figured the upside on FEI was limited, but the upside TRIBE if they succeeded would be much higher. An asymmetric bet, as they call it. I’m still holding, I don’t have any hope of a quick turnaround on this one, but we’ll see what the team — and the community decides to do.

The Coinbase ($COIN) IPO seems to be all over my feed. Their recent filings have come out and the speculation here is that it’s good for the crypto market in general. One it will legitimize the space, since the betting markets are putting it somewhere around $150B in valuation. I’m not going anywhere near this one, just watching my Voyager holdings in the event that I need to dump a part of my position. There’s also the hypothesis that a lot of Coinbase insiders are going to be dumping their shares on the market and putting the proceeds into Bitcoin, so I’m hopeful that it might kickstart the next phase upward.

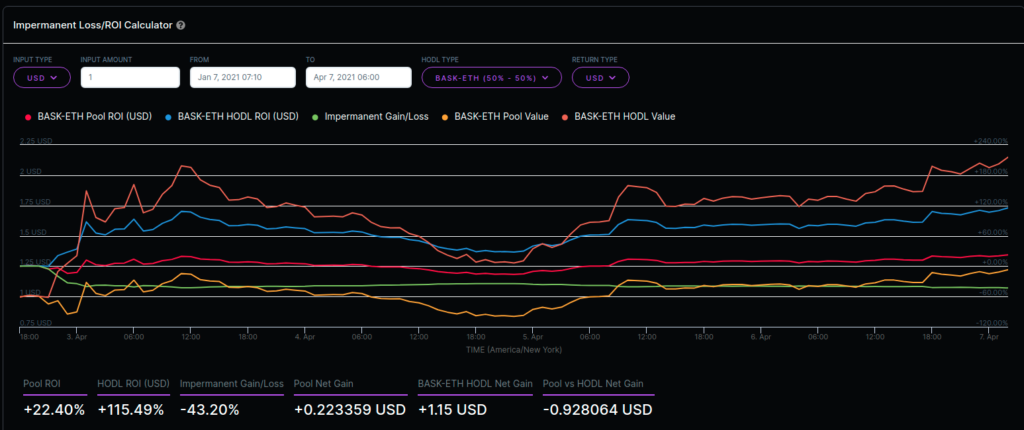

BasketDAO ($BASK) is another project I don’t think I’ve mentioned here. I saw their TVL jump on DeFiLlama, they were offering LP mining for DPI tokens, so I went ahead and aped in. They basically redeemed the DPI for the underlying components and converted them to the yield bearing versions of the tokens, and call it BDPI. Now why didn’t I think of that? My BDPI automatically staked, and is still earning 300% APY via BASK tokens. There’s currently 800% APY on the BASK-ETH APY, even though the IL is fierce. For now, my game is figuring out whether the gas to claim and stake is worth the risk. But let me say also, the Sushiswap analytics page is beautiful.

I’m getting a better feel for all these games over on BSC, and put some funds into several pools, mainly to satisfy my urge to do something. Trading is ultimately a game of waiting, and all of the funds that I’m bringing over from my IRA could ultimately spell doom for me if I’m not careful. But these low-gas chains like BSC and xDAI ultimately give me a chance to test out various strategies on claiming and staking, so it’ll be interesting to see how they play out.

Finally, the most fascinating project to me right now is Alchemix. It’s caused some controversy among TradFi types, here’s the gist. You deposit funds, (DAI, for now) into their vault, and it’s put to use by their strategies, earning yield and boosts, &c… You can take up to 50% out of your staked capital in their arUSD, and sell it for dollars or whatever. You’re basically taking a pre-payment on the future yield, as you never have to pay it back. The yield generated by your deposit is used to pay back your debt. Of course the controversial part of this is the yields generated, but that’s not really the point here. If this works, long term, it is going to change the market significantly. They’re opening ETH and wBTC farms soon, and that will be a remarkable evolution in the space. Instead of staking BTC as collateral and taking a 9% loan with BlockFi if you need cash, you can stake BTC with Alchemix, take the cash for that house or business, and let the loan pay itself off.

Imagine the ramifications. Family fortunes could potentially be put to work this way. Instead of spending your ever-appreciating BTC on a house, you could lock it up for a period of time, get the fiat that you need, and later get back your appreciated BTC. Whether that would be a few months or something more akin to a fifteen or thirty year loan remains to be seen, but the ramifications are going to huge. If it works. I’ll probably take more time to look this over today after I do some more writing.